New construction in Texas: prices, trends, guides & homes as of December 2025

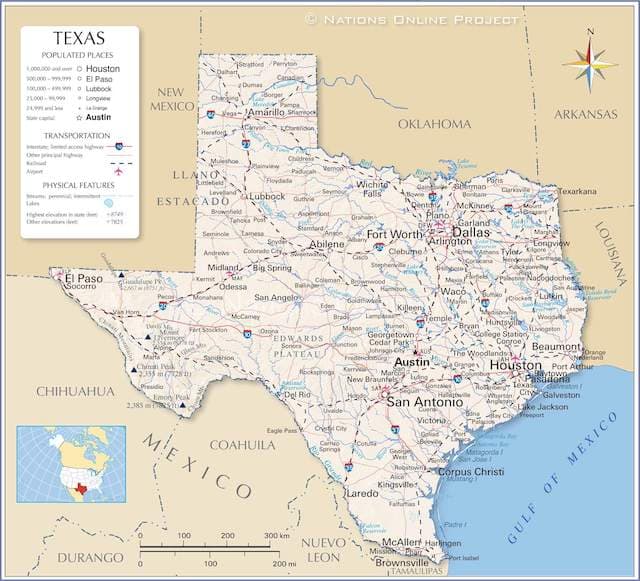

About Texas

Over recent years, Texas has enjoyed one of the highest migration rates across the United States, and it's not difficult to see why. Boasting year-round warm weather, excellent economic opportunities, and a relatively affordable cost of living, Texas is a great place to be. The Lone Star state has a population of 28.7 million, the second largest after California. It also has the second-largest land area in the country after Alaska. Texas was established in 1861, following its annexation during the Mexican-American War. Historically, it has been known for its robust oil and gas industry; however, it has grown into a state with a diverse economy over the last several decades. Texas' tourism, agriculture, and aerospace industries are all booming, and many Fortune 500 companies, such as Exxon Mobil, Sysco, and AT&T, call Texas home. Texas has also evolved into a technological hub over recent years. Companies such as Apple, Google, and Facebook have regional offices in Texas, and there are many thriving technology startups here as well.

How are new home prices changing in Texas?

Home price data reflects current listings in Texas, sourced from Jome and updated regularly

*Based on Jome markets

Chat with Texas Expert

Get a free, no-pressure consultation with our top Texas new-construction expert. They know every major builder, the best deals and incentives, and exactly what's happening in the local new-construction market.

Texas market overview

- Overall inventory71,854

- Single-family inventory69,652

- Townhouse inventory1,339

- Condo inventory584

- Multi-family inventory74

- Penthouse inventory21

- 1 bed inventory179

- 2 beds inventory1,272

- 3 beds inventory23,984

- 4+ beds inventory46,297

- Median home price$399,900

- Median sqft price$187.77

- Median 1 bed price$360,000

- Median 2 beds price$385,000

- Median 3 beds price$330,990

- Median 4+ beds price$456,480

- Min listing price$100,000

- Max listing price$25,500,000

- Min community price$100,000

- Max community price$17,500,000

Texas median price change

| Month | Median price | Change |

|---|---|---|

| December 2025 | $399,990 | - |

Texas real estate markets

Greater Austin Area621 communities13.9% of all TX communities9,636 homes13.4% of all TX homes$445,995 home median price

Greater Austin Area621 communities13.9% of all TX communities9,636 homes13.4% of all TX homes$445,995 home median price Dallas–Fort Worth Area1,640 communities36.8% of all TX communities25,954 homes36.1% of all TX homes$449,990 home median price

Dallas–Fort Worth Area1,640 communities36.8% of all TX communities25,954 homes36.1% of all TX homes$449,990 home median price Greater Houston Area1,368 communities30.7% of all TX communities22,003 homes30.6% of all TX homes$380,000 home median price

Greater Houston Area1,368 communities30.7% of all TX communities22,003 homes30.6% of all TX homes$380,000 home median price Greater San Antonio606 communities13.6% of all TX communities9,456 homes13.2% of all TX homes$339,990 home median price

Greater San Antonio606 communities13.6% of all TX communities9,456 homes13.2% of all TX homes$339,990 home median price

What it's like to live in Texas?

Texas operates as America's second-largest state and fastest-growing major economy, where 30.5 million residents across 268,000 square miles (larger than France) live in nation's most business-friendly environment with zero state income tax creating $3,000 to $15,000 annual savings versus California or New York equivalents, where economic diversity spanning energy (Houston as "Energy Capital of the World" with ExxonMobil, Chevron, ConocoPhillips, Shell USA headquarters plus hundreds of oil and gas companies employing 300,000-plus creating petroleum industry cluster), technology (Austin's "Silicon Hills" with Apple, Tesla, Oracle, Google campuses plus Dallas-Fort Worth corporate tech operations employing 400,000-plus creating nation's fastest-growing tech hub), healthcare (Texas Medical Center Houston — world's largest medical complex with 106,000 employees, MD Anderson Cancer Center, and 60+ institutions), military (Fort Cavazos/formerly Fort Hood 36,000 troops, Fort Bliss 35,000, Joint Base San Antonio complex, multiple installations employing 250,000-plus), logistics and distribution (Dallas-Fort Worth as nation's logistics hub with Amazon, FedEx, UPS massive operations), manufacturing (Toyota headquarters Plano, Tesla Gigafactory Austin, aerospace/defense), agriculture (leading cattle, cotton, hay production though mechanization reduced employment), and corporate headquarters (54 Fortune 500 companies including AT&T, ExxonMobil, McKesson, Phillips 66, Valero versus California's 53) creates economic resilience where job growth, business formation, and population influx from expensive states drove 2010-2024 transformation adding 5+ million residents. However, this explosive growth transformed Texas from affordable alternative into increasingly expensive market where appreciation of 50% to 80% from 2019 to 2024 in major metros driven by California exodus (estimated 700,000 net California migrants 2010-2020 plus hundreds of thousands since), corporate relocations (Oracle, Tesla, HP Enterprise headquarters moves), and domestic migration from expensive states created housing crisis where quality new construction ranges $320,000 to $480,000 in affordable metros (San Antonio, El Paso, Corpus Christi, Lubbock) to $450,000 to $750,000 in expensive metros (Austin, Dallas-Fort Worth, Houston suburbs) approaching or exceeding departure city costs California refugees fled, where property taxes at 1.6% to 2.2% of assessed value (among nation's highest, funding schools and services without income tax) create $6,400 to $13,200 annual bills on $600,000 homes offsetting income tax savings, where homeowner's insurance crisis following Winter Storm Uri (2021 grid failure), Hurricane Harvey (2017 Houston catastrophic flooding), and hail storms caused premiums to surge 40% to 70% with annual costs $2,800 to $5,500 standard homes and $4,500 to $8,500 coastal creating insurance affordability crisis, where climate extremes include brutal summers (100°F to 110°F June through September across much of state creating 250+ annual heat-related deaths), hurricane risk (Gulf Coast Harvey devastation demonstrated vulnerability with $125 billion damages and 68 deaths), tornado risk (Texas averages 140 tornadoes annually ranking second nationally), winter storm vulnerability (Uri grid failure left millions without power during freezing creating 246 deaths exposing infrastructure fragility), and drought cycles affecting water supplies, where traffic congestion in Dallas-Fort Worth, Houston, and Austin rivals Los Angeles destroying quality of life with 90-minute commutes standard, where public transportation remains minimal forcing car dependence, where political battles over abortion restrictions, voting laws, education, and social issues create divisive environment, where electrical grid concerns following Uri failures create ongoing reliability questions during extreme weather, where water scarcity threatens long-term growth particularly in West Texas and Hill Country, and where the trade-offs involve accepting that Texas offers zero income tax savings, robust job growth across diverse industries, lower housing costs than California/Northeast/expensive states (though margins narrowing rapidly), business-friendly environment, warm climate year-round, BBQ and Tex-Mex food culture, Friday night football and cultural pride, but delivers these through property taxes approaching income tax burden when combined with insurance, climate extremes making summers brutal and creating weather dangers, explosive growth overwhelming infrastructure and eliminating affordability advantage in major metros, car-dependent sprawl extending 60+ miles from city centers, conservative political culture limiting social progressivism, and reality that Texas success pricing Texans out as California equity and corporate money make Lone Star State increasingly unaffordable for working families earning Texas wages in America's business capital where "Don't California My Texas" sentiment reflects native frustration with migrants driving appreciation while economic prosperity and population boom create nation's most dynamic but also most rapidly changing major state.

Understanding Texas by region, economy, and massive geographic diversity

Texas's 268,000 square miles create geographic and economic diversity where understanding regional differences proves essential — Gulf Coast humidity differs fundamentally from West Texas desert, Dallas corporate culture contrasts Austin progressive tech scene, and housing costs vary from $180,000 El Paso median to $550,000 Austin median representing 3x difference within single state.

Major Metropolitan Regions and Economic Drivers:

Dallas-Fort Worth Metroplex (7.8 million, nation's 4th-largest metro) operates as corporate headquarters capital and logistics hub where Fortune 500 concentration (23 companies including AT&T, ExxonMobil, American Airlines, McKesson) creates white-collar employment, DFW Airport (world's 2nd-busiest, American Airlines primary hub) generates logistics cluster, technology sector growth attracted Oracle headquarters relocation plus established Texas Instruments operations, telecommunications (AT&T, Verizon operations), financial services, healthcare, and diverse economy. Quality new construction $450,000 to $750,000 in desirable suburbs (Plano, Frisco, McKinney north, Southlake, Colleyville west) approaching Denver or Seattle suburbs despite Texas reputation for affordability. Median home price $380,000. Climate: hot humid summers 95°F to 102°F, mild winters occasional freezes, tornado risk spring. Character: sprawling corporate suburban development, car-dependent, conservative business culture, explosive growth.

Houston (7.1 million, nation's 5th-largest metro) functions as "Energy Capital of the World" where oil and gas industry dominance creates boom-bust cycles tied to crude prices, Port of Houston (nation's busiest by tonnage) generates massive logistics employment, Texas Medical Center (world's largest medical complex, 106,000 employees), aerospace (NASA Johnson Space Center, Boeing operations), petrochemical manufacturing, international trade given proximity to Mexico and port access. Quality new construction $420,000 to $680,000 in desirable areas (Katy west, Woodlands north, Sugar Land southwest, Memorial inside Loop, Energy Corridor). Median home price $320,000. Climate: hot humid subtropical, hurricane risk (Harvey 2017 catastrophic flooding $125 billion damages), oppressive humidity. Character: sprawling energy city, diverse (most diverse major U.S. metro), unzoned development creating mixed-use chaos, flooding concerns, energy industry volatility.

San Antonio (2.6 million, nation's 7th-largest metro) centers on military (Joint Base San Antonio — Fort Sam Houston, Lackland AFB, Randolph AFB — employing 80,000 military and civilian creating "Military City USA"), tourism (Alamo, River Walk attracting 34 million annual visitors), healthcare (UT Health San Antonio, military medicine), cybersecurity growth, and services economy. Quality new construction $320,000 to $480,000 remaining Texas's most affordable major metro. Median home price $280,000. Climate: hot semi-arid, occasional Hill Country elevation relief, mild winters. Character: military town character, Hispanic cultural heritage (64% Hispanic), affordable, River Walk tourism, slower-paced than Dallas/Houston/Austin.

Austin (2.4 million, nation's 11th-largest metro) operates as "Silicon Hills" tech hub where explosive growth attracted Apple (campus for 15,000), Tesla Gigafactory, Oracle headquarters relocation, Google, Amazon, Meta substantial operations creating 100,000-plus tech employment, University of Texas (51,000 students), state government (Texas capital), live music scene ("Live Music Capital of the World"), and progressive culture creating most expensive Texas market. Quality new construction $550,000 to $900,000 in desirable areas (Westlake, Tarrytown, Circle C, Cedar Park, Round Rock suburbs). Median home price $550,000. Climate: hot summers 95°F to 105°F, mild winters, Hill Country setting, Barton Springs natural pool, drought concerns. Character: progressive liberal enclave in conservative Texas creating "Keep Austin Weird" identity, explosive growth destroying affordability, California migration concentration, traffic nightmares, tech culture.

El Paso (850,000) sits on Mexican border and Rio Grande where binational economy integrates with Ciudad Juárez Mexico (1.5 million across border), Fort Bliss (35,000 troops, Army air defense, largest U.S. installation by land area), healthcare, logistics, manufacturing (maquiladoras cross-border operations), University of Texas El Paso (25,000 students). Quality new construction $250,000 to $380,000 maintaining extreme affordability. Median home price $240,000. Climate: Chihuahuan Desert, hot dry, mild winters, 300+ days sunshine. Character: isolated (nearest major city 270 miles), bilingual bicultural (82% Hispanic), desert mountain setting Franklin Mountains, affordable, border economy. Additional Regions:

Rio Grande Valley (far south Texas bordering Mexico — Brownsville, McAllen, Harlingen, 1.4 million combined) operates as agricultural region (citrus, vegetables, cotton) plus maquiladora manufacturing, Winter Texan snowbird destination (100,000-plus seasonal residents November-March), extreme poverty (among nation's poorest metros median income $38,000 to $42,000), affordable housing ($180,000 to $320,000 new construction), subtropical climate, 84% to 92% Hispanic, Spanish-dominant in many areas. Points of interest include South Padre Island beach resort, SpaceX Starbase Boca Chica launching facilities, historic mission churches, birding ecotourism.

Corpus Christi (430,000, Gulf Coast) centers on Port of Corpus Christi (energy export hub particularly crude oil), petrochemical refining, Naval Air Station Corpus Christi (Navy pilot training "Home of Naval Aviation Training"), tourism (beaches, Padre Island National Seashore), manufacturing. Affordable $280,000 to $420,000 new construction. Hurricane risk, hot humid coastal climate.

Lubbock (320,000, South Plains) operates as agricultural hub ("Hub of the Plains"), Texas Tech University (40,000 students), healthcare, cotton production, wind energy. Very affordable $240,000 to $360,000 new construction. Climate: semi-arid, high winds, dust storms, extreme flatness, isolated 300 miles from major cities. Conservative agricultural character.

Amarillo (265,000, Texas Panhandle) serves as cattle feedlot center, agricultural economy, Pantex Plant (nuclear weapons assembly/disassembly), small city character. Very affordable. Extreme climate flat plains, brutal winds, isolated.

Midland-Odessa (340,000 combined, Permian Basin) operates as oil and gas boom-bust economy where crude prices determine prosperity or recession, energy employment, extreme housing volatility (median prices $320,000 in boom to $220,000 in bust). Climate: high desert, hot summers, cold winters, dust storms, isolated. The Zero Income Tax Advantage and Property Tax Reality:

Texas's zero state income tax creates $3,000 to $15,000 annual savings compared to California (13.3% top rate), New York (10.9%), or other high-tax states — a household earning $100,000 saves approximately $5,000 to $8,000 annually versus California equivalent. However, Texas funds government through nation's highest property taxes averaging 1.6% to 2.2% of assessed value (versus 0.7% national average). On a $600,000 home, annual property tax bills range $9,600 to $13,200 — far exceeding most states. Combined with homeowner's insurance crisis ($2,800 to $5,500 annually standard homes, $4,500 to $8,500 coastal), total housing costs beyond mortgage reach $1,200 to $1,900 monthly. The calculation whether Texas saves money versus California requires examining total tax burden — while income tax savings prove real, property taxes plus insurance plus sales tax 6.25% to 8.25% plus higher utility costs (summer AC bills $250 to $450 monthly common) create situations where total costs approach expensive-state levels though remain 15% to 30% below California/New York equivalents.

The Climate Extremes and Natural Disaster Portfolio:

Texas's massive geography creates climate diversity and disaster exposure:

- Summer Heat: Brutal across most of state June through September with Dallas-Fort Worth, Austin, San Antonio, Houston regularly exceeding 100°F to 105°F, West Texas reaching 110°F, creating 250+ annual heat-related deaths, electricity consumption skyrocketing (AC bills $300 to $500 monthly standard), and outdoor activities limited to early morning or evening.

- Hurricane Risk: Gulf Coast (Houston, Corpus Christi, Beaumont, Galveston) faces serious hurricane exposure. Hurricane Harvey (2017) demonstrated catastrophic flooding potential — Harvey dropped 60+ inches rain in areas causing $125 billion damages, killing 68, flooding 300,000 structures, and proving Houston's flat terrain, concrete development, inadequate drainage create flooding nightmare when hurricanes stall. Hurricane Ike (2008), Hurricane Rita (2005) caused prior devastation. Insurance crisis followed with carriers exiting coastal market.

- Tornado Risk: Texas averages 140 tornadoes annually (second only to Kansas per capita), particularly North Texas, Panhandle, and East Texas during spring March-May creating deadly risk proven by numerous outbreaks.

- Winter Storm Vulnerability: Winter Storm Uri (February 2021) exposed Texas grid fragility when temperatures dropped to single digits statewide causing ERCOT grid failure, leaving 4.5 million without power during freezing for days, killing 246 from hypothermia and carbon monoxide poisoning, bursting pipes causing billions in damages, and demonstrating infrastructure inadequacy for cold extremes. The crisis raised ongoing concerns about ERCOT grid reliability during extreme weather.

- Drought and Water Scarcity: Texas experiences cyclical droughts affecting agriculture, water supplies, and wildfire risk. Lake levels fluctuate dramatically. Hill Country particularly vulnerable given population growth outpacing water supplies. Edwards Aquifer supporting San Antonio faces depletion concerns.

Understanding Texas by buyer profile and migration dynamics

Texas's explosive growth driven by California exodus, corporate relocations, and domestic migration from expensive states creates buyer profiles where equity refugees dominate purchases while native Texans face pricing pressure.

For California Equity Refugees and Coastal Migrants (Dominant Buyer Segment): The California exodus represents Texas's transformative demographic trend. An estimated 700,000 net California migrants 2010-2020 plus hundreds of thousands since brought equity, incomes, and housing expectations that drove Texas appreciation. These migrants — typically ages 28 to 65 earning $85,000 to $250,000 or retirees with accumulated California equity — sold $750,000 to $1.5 million California homes (modest properties in Bay Area, Los Angeles, San Diego, Orange County) purchasing $450,000 to $850,000 Texas properties, banking $300,000 to $650,000 difference while gaining larger homes (California 1,400 sq ft versus Texas 2,800 sq ft standard), newer construction, yards, garages, lower taxes, and business-friendly environment. They concentrated in Austin (California transplants represent estimated 30% to 40% of recent growth), Dallas-Fort Worth (Frisco, Plano, McKinney attracted Silicon Valley tech workers), Houston (energy professionals), and San Antonio. California migrants bring housing expectations where $650,000 for Texas 3,000 sq ft new construction feels like bargain compared to $1.2 million for California 1,600 sq ft, making them willing to pay prices native Texans consider insane. However, the massive California influx created "Don't California My Texas" political backlash — native Texans resent California license plates, newcomers driving appreciation pricing out locals, and fears California progressive politics/regulations/taxes follow migrants threatening Texas's business-friendly conservative model. Some California migrants discover brutal Texas summer heat (110°F June through September), lack of California amenities (mountains, ocean, outdoor year-round), car-dependent sprawl, conservative social culture, and regret relocations "half-backing" to California after few years. However, most remain finding financial benefits and space justify trade-offs.

For Corporate Relocators and Tech Workers: Oracle headquarters move to Austin (2020), Tesla Gigafactory Austin, HP Enterprise headquarters move to Houston, and numerous companies relocating from California/expensive states brought employees or attracted migrations. Tech workers earning $90,000 to $180,000 relocated to Austin, Dallas-Fort Worth (Plano-Frisco tech corridor), Houston purchasing $480,000 to $950,000 homes finding Texas costs lower than Bay Area though appreciation approaching departure cities eliminated expected massive savings. Dual-income tech households earning combined $180,000 to $320,000 purchase $700,000 to $1.5 million premium locations. However, Texas tech salaries run 15% to 25% below California while housing appreciated to levels approaching less-expensive tech hubs eliminating "affordable tech alternative" narrative Austin marketed.

For Energy Sector Professionals (Houston Concentration): Houston's energy dominance creates concentrated buyer segment — petroleum engineers, geologists, energy executives, oil traders, refinery operators earning $75,000 to $250,000-plus purchase throughout Houston metro particularly Energy Corridor, Memorial, Katy, Woodlands. However, energy volatility creates boom-bust cycles affecting employment and housing — oil price crashes cause layoffs, while booms bring hiring and appreciation. The cyclical nature creates hesitancy where some energy workers rent rather than purchase anticipating potential relocations to other energy hubs if Houston employment ends.

For Military Families Serving Massive Texas Installations: Texas military concentration — Fort Cavazos 36,000 troops (Killeen), Fort Bliss 35,000 (El Paso), Joint Base San Antonio 80,000 combined, Fort Hood 12,000 (Wichita Falls), Naval Air Station Corpus Christi, multiple installations — creates substantial military buyer demand. Junior enlisted struggle affording housing, NCOs and officers purchase near bases using VA loans. However, constant PCS rotations create transient populations and resale focus.

For Retirees Seeking Warm Climate and Tax Advantages: Texas attracts substantial retiree settlement seeking warm climate, zero income tax on retirement income (Social Security, pensions, 401k distributions all untaxed versus California taxing), lower costs than California/Florida coastal, and conservative culture. However, retirees discover brutal summer heat (four months 100°F-plus daily), property taxes still affect fixed incomes ($9,000 to $13,000 annually on $600,000 homes), hurricane risk coastal areas, and healthcare requiring research quality facilities available.

For Hispanic/Latino Populations and Generational Texans: Texas's 40% Hispanic population (11.4 million, second-largest Hispanic population by state after California) includes generational Texans with deep roots, recent Mexican immigrants, and diverse Latino communities. Hispanic buyers purchase throughout state particularly South Texas (Rio Grande Valley 84% to 92% Hispanic), San Antonio (64% Hispanic), El Paso (82% Hispanic), Houston diverse neighborhoods, and throughout metro areas.

For Working Families and Middle-Class Texans Facing Pricing Pressure: Native working Texans earning $55,000 to $105,000 household incomes face severe challenges affording homes in metros where California equity drove appreciation — $450,000 starter homes in Frisco/McKinney require $160,000-plus household income, pricing out teachers ($48,000 to $68,000), nurses ($65,000 to $90,000), working families, and middle-class. Many pushed to distant suburbs accepting brutal 75 to 120-minute commutes for affordability or relocating to San Antonio, El Paso, Corpus Christi, Lubbock, or smaller metros maintaining accessibility.

The substantial costs beyond mortgage in nation's highest property tax state

- Property taxes at 1.6% to 2.2% of assessed value vary by county and school district but universally high. On $600,000 home: $9,600 to $13,200 annually ($800 to $1,100 monthly). Texas offers homestead exemption ($100,000 assessed value exempt) and over-65 exemptions reducing burden though still substantial. Annual reassessments capture appreciation creating tax increases.

- Homeowner's insurance crisis: Annual premiums $2,800 for newer suburban homes to $4,500 older homes to $6,500 specific situations. Coastal Gulf areas $4,500 to $8,500. Winter Storm Uri, Hurricane Harvey, hail storms caused 40% to 70% premium increases 2020-2024. New construction typically $3,200 to $4,500 annually.

- Flood insurance: Required for mortgaged properties FEMA flood zones. Houston particularly affected given flat terrain and flooding history — flood insurance $2,200 to $6,000 annually adds substantial costs.

- Utilities: Summer AC dominates costs — June through September electric bills $250 to $450 monthly common in Dallas, Austin, Houston, San Antonio creating annual electricity costs $3,500 to $5,500. ERCOT deregulated electricity market creates variable pricing. Combined costs — property taxes $900 monthly, insurance $325 monthly, utilities $300 monthly averaged — create $1,525 monthly beyond principal and interest.

Points of Interest Defining Texas Identity and Tourism

Texas's massive geography creates diverse attractions naturally woven into regional identities:

- Hill Country: (Austin, San Antonio area) Rolling limestone hills, Enchanted Rock State Natural Area (pink granite dome), Fredericksburg German heritage town and wineries, LBJ Ranch, Hamilton Pool natural swimming hole, Guadalupe River tubing, Luckenbach honky-tonks, live oak and juniper landscapes creating scenic beauty contrasting flat prairies.

- Big Bend National Park: (Far West Texas) 801,000-acre park along Rio Grande featuring Chisos Mountains, desert landscapes, Rio Grande canyons, dark skies, remote wilderness. Nearest services Alpine/Marfa 100+ miles creating isolation appeal for nature seekers.

- Gulf Coast Beaches: South Padre Island (Spring Break destination, beach resort), Galveston (historic island city, beaches, Victorian architecture Strand Historic District), Corpus Christi beaches, Port Aransas, Padre Island National Seashore (longest undeveloped barrier island in world).

- San Antonio River Walk: Iconic pedestrian riverwalk lined with restaurants, bars, hotels creating tourism destination attracting 34 million annually. The Alamo ("Remember the Alamo!" 1836 Texas Revolution battle site), San Antonio Missions National Historical Park (Spanish colonial missions).

- Dallas-Fort Worth: Sixth Floor Museum (JFK assassination Dealey Plaza), Fort Worth Stockyards (cattle drives, Western heritage, honky-tonks), Dallas Arts District, AT&T Stadium (Cowboys massive venue).

- Houston: Space Center Houston (NASA Johnson Space Center visitor center, Mission Control), Museum District (19 museums including Museum of Fine Arts, Natural Science), diverse international dining (most diverse major U.S. metro).

- Austin: State Capitol (tallest state capitol building), Sixth Street entertainment district (live music), Barton Springs Pool (natural spring-fed pool in Zilker Park), University of Texas campus and Darrell K Royal–Texas Memorial Stadium, SXSW festival.

- West Texas: Marfa (contemporary art destination, Prada Marfa installation, Marfa Lights mystery), Guadalupe Mountains National Park (Texas highest peak Guadalupe Peak 8,749 feet), Palo Duro Canyon (second-largest canyon system U.S., "Grand Canyon of Texas").

- Panhandle: Cadillac Ranch (art installation buried Cadillacs), Palo Duro Canyon, cattle ranching heritage, Amarillo.

- Piney Woods: (East Texas) Loblolly pine forests contrasting Western deserts, Caddo Lake (cypress swamp), National Forests.

Why Texas-specialist representation matters critically across massive, diverse state

Independent buyer's agents help navigate which Texas metros/regions align with priorities (tech Austin, energy Houston, corporate Dallas, military San Antonio, affordability El Paso/Lubbock/Corpus), evaluate property tax implications varying dramatically by school district and county, understand insurance crisis and coastal hurricane exposure, assess climate fit recognizing summers brutal across state, identify California migration concentration areas, explain ERCOT grid reliability concerns following Uri, research school districts varying quality dramatically within metros, and ensure buyers — particularly California refugees and out-of-state relocators — understand Texas realities: zero income tax savings real but offset by nation's highest property taxes plus insurance crisis, explosive growth drove appreciation eliminating affordability advantage major metros approaching departure city costs, brutal summer heat 100°F to 110°F four months limiting outdoor activities, car-dependent sprawl requiring driving everywhere distances Californians find shocking, hurricane risk Gulf Coast proven catastrophically real by Harvey, tornado risk throughout state, winter storm vulnerability following Uri grid failure demonstrating infrastructure fragility, water scarcity threatening long-term growth, conservative political culture limiting social progressivism, while recognizing Texas offers robust job growth across diverse industries, business-friendly environment attracting corporations, larger homes and yards than expensive states, Friday night football and cultural pride, BBQ and Tex-Mex, warm climate year-round, and economic opportunity in Lone Star State where explosive growth, California exodus, and corporate relocations created America's fastest-growing economy transforming affordable Texas alternative into increasingly expensive market where "Don't California My Texas" reflects native frustration with success pricing out working Texans while economic prosperity continues attracting millions seeking opportunity in nation's business capital where everything's bigger including challenges rapid growth inevitably creates.

Where can I find new homes?

Browse currently available new construction homes, communities, and floor plans across the Texas. All listings are updated daily with the latest inventory from builders. Browse all communities & new homes in Texas

Explore other states in the Southwest

Top-rated new construction communities in Texas

Master planned communities in Texas

Real estate in Texas

There are approximately 1,700 cities in Texas, with populations ranging from 2.3 million to less than 100 people. According to Pricewaterhouse Coopers and the Urban Land Institute's Emerging Trends in Real Estate 2022 research, Texas has 4 of the top 12 markets in the United States with the highest house-building prospects. Texas housing market trends have been fascinating to watch in 2022. Using several statistics, we have examined the Texas housing market throughout the year to understand where it is headed in 2023. A lack of inventory is keeping Texas housing prices high, but the rate of appreciation has slowed significantly compared to the last two years. In 2022-23, some of Texas's fastest-growing real estate markets will be in highly desirable areas, particularly in the suburbs of major metropolitan cities.

Newly released communities

Recently listed homes

Recently published floor plans

The most popular new construction builders in Texas

Want to learn more about new construction?

Frequently asked questions

What is the current median sale price for a property in Texas?

In the Texas, the current median sale price stands at $399,990 as of December 2025. This figure is derived from an analysis of 72021 newly built properties, constructed by 462 local and national builders.

Who are the major developers of new construction homes in Texas?

Texas's real estate market offers many new construction options, with Lennar, Perry Homes, D.R. Horton, Bloomfield Homes and Highland Homes as the main developers. These builders create communities suited to modern living.