New construction in South Carolina: prices, trends, guides & homes as of December 2025

About South Carolina

South Carolina, a state known for its captivating blend of natural beauty, rich history, and cultural diversity, offers many possibilities to prospective residents and visitors alike. Its stunning natural wonders range from the high peaks of the Blue Ridge Mountains to the magnetic stretches of its coastal plains, presenting ample opportunities for outdoor lovers. Whether your interests lie in hiking, fishing, or simply soaking up the sun on the beach, South Carolina promises to deliver whatever you need. Residents enjoy a subtropical climate marked by mild winters and warm summers. This weather pattern allows for outdoor activities to be enjoyed for much of the year. The growing season also varies, stretching from under 200 days in the northwestern regions to roughly 290 days on the Sea Islands. In terms of things to do, South Carolina has plenty to do with its vibrant arts scene and dynamic sports culture. The state hosts numerous art festivals, galleries, and theaters that feature both traditional and contemporary arts. Events like the Spoleto Festival USA in Charleston and Artisphere in Greenville showcase the state's artistic vibrancy and its commitment to supporting both local and international artists. Sports fanatics would enjoy South Carolina's strong affiliation with college football, particularly the spirited rivalry between the Clemson University Tigers and the University of South Carolina Gamecocks. Finally, South Carolina's growth rate has consistently exceeded the national average since the 1970s, signaling a flourishing economy and increased opportunities. Moreover, the state's population is one of the fastest aging in the country, making it a desirable destination for retirees. South Carolina's metropolitan areas, especially in the Midlands and along the coast, have been steadily growing, offering diverse opportunities for both work and leisure. From its stunning natural parks and thriving arts and sports culture to its growing economy, South Carolina offers a truly compelling case for anyone considering a move.

How are new home prices changing in South Carolina?

Home price data reflects current listings in South Carolina, sourced from Jome and updated regularly

*Based on Jome markets

Chat with South Carolina Expert

Get a free, no-pressure consultation with our top South Carolina new-construction expert. They know every major builder, the best deals and incentives, and exactly what's happening in the local new-construction market.

South Carolina market overview

- Overall inventory9,619

- Single-family inventory8,694

- Townhouse inventory778

- Condo inventory28

- Multi-family inventory69

- Penthouse inventory0

- 1 bed inventory4

- 2 beds inventory428

- 3 beds inventory4,702

- 4+ beds inventory4,482

- Median home price$345,202.5

- Median sqft price$178.79

- Median 1 bed price$287,400

- Median 2 beds price$375,999

- Median 3 beds price$309,200

- Median 4+ beds price$398,829

- Min listing price$144,900

- Max listing price$15,795,000

- Min community price$169,149

- Max community price$1,975,000

South Carolina median price change

| Month | Median price | Change |

|---|---|---|

| December 2025 | $348,900 | - |

South Carolina real estate markets

What it's like to live in South Carolina?

South Carolina operates as a manufacturing powerhouse disguised as a coastal tourism destination. While visitors see Charleston's historic architecture and Myrtle Beach's tourist infrastructure, the economic reality centers on aerospace assembly, automotive production, and military installations that have transformed the state's employment landscape over the past two decades. The Upstate around Greenville and Spartanburg functions as an advanced manufacturing corridor. The Lowcountry around Charleston balances Boeing's massive 787 Dreamliner operation with port activity and military installations. The Grand Strand serves tourism and retirees seeking beach access at costs well below Florida. Columbia anchors state government and university employment. The common thread connecting these regions is South Carolina's business-friendly environment, relatively low cost of living, and absence of state tax on Social Security income that makes it particularly attractive to retirees and manufacturers seeking non-union workforces.

Why South Carolina has emerged as a relocation target

The financial case starts with a moderate tax structure that favors specific demographics. South Carolina doesn't tax Social Security benefits, making it immediately attractive to retirees compared to states that do. The top state income tax rate sits at 6.5%, lower than neighboring North Carolina's 4.75% to 5.25% but higher than Florida and Tennessee's zero. However, property taxes run substantially lower than most growth states, with effective rates typically between 0.50% and 0.70% of assessed value, roughly half what Texas charges and well below New Jersey or Illinois. For a household earning $110,000 annually, the combined tax burden lands meaningfully below northeastern states while remaining competitive with other southeastern options.

The job market has evolved dramatically from the state's textile manufacturing past. Boeing's North Charleston facility assembles 787 Dreamliners in a massive operation employing tens of thousands directly and supporting an even larger aerospace supplier ecosystem throughout the region. Volvo's state-of-the-art Ridgeville facility produces EVs and SUVs with capacity reaching 150,000 units annually, anchoring automotive manufacturing that includes major suppliers and a growing electric vehicle focus. The Upstate's manufacturing corridor stretches from Greenville through Spartanburg, with companies across automotive, aerospace, and advanced manufacturing creating sustained demand for engineers, technicians, and skilled trades workers. Military installations including Joint Base Charleston at the former Naval Weapons Station create stable employment for active-duty personnel, civilian contractors, and defense industry workers. Port of Charleston operations drive logistics and distribution employment. Tourism along the coast from Myrtle Beach through Hilton Head generates seasonal and year-round hospitality jobs, though these typically pay less than manufacturing positions.

The cost of living remains meaningfully below comparable metros in North Carolina, Virginia, or Florida. Charleston has experienced rapid appreciation but still offers new construction at price points that Austin or Raleigh have surpassed. Greenville and Spartanburg provide genuine affordability with quality suburban homes available well below $400,000. Columbia sits in the middle, serving as the state capital with stable government employment and University of South Carolina anchoring the economy. Manufacturing job growth has attracted workers from higher-cost states, with new communities responding to this sustained demand.

The climate offers four seasons without harsh extremes. Coastal areas rarely see freezing temperatures, while the Upstate experiences genuine winter with occasional snow. Summers run hot and humid statewide, with temperatures regularly reaching the low 90s from June through August. Hurricane risk affects coastal areas but remains less intense than Florida's exposure, with most storms weakening before making landfall. The practical reality for homebuyers means lower insurance costs than Florida while maintaining year-round mild weather that northern transplants seek.

Understanding South Carolina's markets by buyer profile

South Carolina's economic transformation has created distinct buyer profiles concentrated in specific regions based on employment patterns and lifestyle priorities, with builders developing communities targeting these demographics.

For Aerospace Engineers and Manufacturing Professionals: Charleston's Boeing operation dominates this segment, attracting aerospace engineers, quality inspectors, program managers, and skilled technicians from across the country. These buyers relocate from Washington State, Southern California, Texas, and other aerospace hubs, often taking lateral moves or modest pay adjustments for South Carolina's lower cost of living and lack of unions. The 787 assembly operation requires sophisticated engineering talent, creating demand for housing within reasonable commutes to the North Charleston facility. New construction in Berkeley County, Summerville, and northern Charleston suburbs serves this demographic, with price points ranging from $360,000 to $580,000 for quality properties. These professionals seek modern floor plans with home offices for technical work, strong internet infrastructure for collaboration with other Boeing facilities worldwide, and access to decent schools for families. Many maintain professional networks requiring occasional travel, making proximity to Charleston International Airport valuable. The work often involves shift schedules and production deadlines, making commute times a priority consideration.

For Automotive Industry Workers Across Skill Levels: The Upstate manufacturing corridor and Volvo's Ridgeville facility serve workers ranging from assembly line technicians to automotive engineers. Volvo's focus on EV production attracts engineers with electric vehicle experience, battery technology expertise, and software integration skills. The Ridgeville location between Charleston and Columbia creates housing demand in both directions, with buyers seeking maximum value and reasonable commutes. New construction in Dorchester County and Orangeburg County serves this market at price points from $280,000 to $450,000. The Upstate's deeper manufacturing concentration around Greenville and Spartanburg attracts workers from traditional automotive backgrounds plus advanced manufacturing specialists working with robotics and automation systems. These buyers prioritize practical layouts with garage space for project vehicles and tools, larger lots where they can store recreational equipment, and communities without restrictive HOAs limiting automotive work. Price points in the Upstate range from $290,000 to $480,000, offering better square footage per dollar than Charleston while maintaining access to strong employment.

For Military Families and Defense Contractors: Joint Base Charleston, encompassing the former Naval Weapons Station in Goose Creek and other military facilities, creates sustained demand from active-duty personnel, military retirees, and defense contractors supporting base operations. Military families prioritize short commutes for shift work and unpredictable schedules, strong school districts to provide stability during assignments, and communities with other military families who understand deployment realities. New construction in Berkeley County near Goose Creek, Summerville, and Hanahan serves this market, with price points typically ranging from $310,000 to $460,000. VA loan usage with zero down payment makes new construction particularly attractive when builders offer incentives offsetting closing costs. The military buyer demographic includes both junior enlisted personnel purchasing their first homes and senior officers seeking larger properties for families. Defense contractors working in aerospace and maritime industries often earn higher salaries and purchase in the $450,000 to $600,000 range, seeking neighborhoods with other professionals rather than traditional military communities.

For Remote Workers Seeking Value and Quality of Life: South Carolina has captured remote worker migration from higher-cost states, particularly from the Northeast and Mid-Atlantic regions. These buyers can work from anywhere and prioritize lower costs, improved weather, and better housing value than their departure markets offered. Charleston attracts remote workers seeking coastal lifestyle and cultural amenities despite elevated costs compared to other South Carolina markets. Greenville has emerged as a surprise favorite among remote workers, offering a revitalized downtown with restaurants and cultural venues, proximity to mountains for outdoor recreation, and new construction from $340,000 to $520,000. Columbia serves budget-conscious remote workers accepting less cultural dynamism in exchange for the state's lowest housing costs. These buyers need reliable internet infrastructure, dedicated home office spaces, and proximity to airports for occasional work travel. Greenville-Spartanburg International Airport and Charleston International Airport both offer reasonable service, though neither matches major hubs for flight frequency. Remote workers show wide price range variation from $320,000 to $650,000 depending on their compensation levels and whether they're relocating from expensive coastal markets or more affordable regions.

For Retirees Across Income and Lifestyle Segments: South Carolina's combination of no Social Security tax, mild climate, and coastal access attracts retirees from cold-weather states and higher-tax regions. This segment splits by income level and priorities. Hilton Head and Kiawah Island attract affluent retirees seeking golf course communities and beach access, with new construction ranging from $550,000 to $1,500,000-plus. Myrtle Beach and the Grand Strand serve middle-income retirees seeking entertainment options and beach proximity at lower costs, with new construction from $280,000 to $450,000. Beaufort and Bluffton appeal to military retirees drawn by the Marine Corps presence at Parris Island and the lifestyle balance between coastal access and small-town character. The Upstate attracts retirees prioritizing mountains over beaches, with communities near Greenville offering four-season climate and cultural amenities at price points from $310,000 to $480,000. These buyers universally seek single-story layouts, master-on-main configurations, and communities with lawn maintenance services. Access to quality healthcare becomes increasingly important with age, making proximity to major hospital systems a decision factor. MUSC in Charleston and Greenville Health System in the Upstate anchor the state's best medical facilities.

For College-Connected Professionals and Young Families: University of South Carolina in Columbia and Clemson University in the Upstate create housing demand from faculty, administrators, graduate students with families, and young professionals seeking college town amenities. Columbia offers the most affordable entry point for this demographic, with new construction townhomes from $240,000 and single-family homes from $300,000 in workable locations. Greenville's proximity to Clemson and its own growing urban core attracts young professionals seeking walkable neighborhoods and cultural energy, with price points from $320,000 to $480,000. Charleston captures young professionals in hospitality, tourism, and the growing tech sector, though affordability has become challenging with new construction starting around $380,000 for basic properties. These buyers often prioritize location over square footage, seeking neighborhoods with restaurant access, entertainment options, and communities of peers rather than maximizing space in distant suburbs.

For Education-Focused Families Seeking Strong Schools: School district quality varies dramatically across South Carolina, with some districts ranking among the Southeast's best while others struggle significantly. Fort Mill and surrounding areas in York County near the North Carolina border consistently perform well, creating intense demand and corresponding price premiums. Lexington County districts near Columbia maintain solid reputations. Specific schools within Charleston County perform strongly despite broader district challenges, requiring families to research attendance zones carefully rather than relying on district-wide ratings. Greenville County offers pockets of excellence. New construction communities have positioned strategically within high-performing zones where available, though South Carolina's overall education rankings mean families relocating from states like Massachusetts or Virginia often adjust expectations downward. These families prioritize location over square footage, accepting smaller floor plans to secure addresses within boundaries that protect resale value. Price points range from $360,000 in Upstate school zones to $550,000-plus near Fort Mill where proximity to Charlotte creates additional demand.

The actual cost structure beyond your mortgage

Your real monthly housing expense in South Carolina extends beyond principal and interest, with the state's cost structure creating specific advantages and challenges that require evaluation.

Property taxes represent South Carolina's most significant financial advantage over many competing states. The average effective rate statewide runs approximately 0.50% to 0.70% of assessed value, well below national averages and dramatically lower than Texas, New Jersey, or Illinois. However, South Carolina uses a 4% assessment ratio for primary residences rather than taxing full market value, meaning your $400,000 home gets taxed as if it's worth $16,000. The actual tax calculation applies the millage rate to this assessed value. Counties and municipalities set their own millage rates, creating variation across the state. Charleston County effective rates land around 0.50% to 0.65% of actual value. Greenville County runs similar. Rural counties often charge less. On a $400,000 home, expect annual tax bills ranging from roughly $2,000 to $2,800, dramatically lower than comparable properties in many competing states. Homestead exemptions provide additional relief for primary residences, though the exact exemption amount varies by county and age.

State income tax sits at 6.5% maximum, applying to wages and investment income. However, South Carolina doesn't tax Social Security benefits, creating immediate advantage for retirees compared to states that do. Military retirement pay receives partial exemption. The combined state and local tax burden remains moderate compared to northeastern states while running somewhat higher than Florida and Tennessee's zero income tax states.

Sales tax across the state ranges from 6% to 9%, with the state collecting 6% and local jurisdictions adding up to 3%. This affects major purchases including vehicles, where a $42,000 SUV carries $2,520 to $3,780 in sales tax. Furniture, appliances, and building materials all include this premium.

Homeowner's insurance costs run meaningfully lower than Florida but higher than landlocked states. Coastal properties face hurricane risk requiring windstorm coverage, though South Carolina's exposure remains less severe than Florida's, resulting in lower premiums. Coastal insurance typically ranges from $1,800 to $3,500 annually for standard single-family homes depending on specific location and proximity to water. Inland properties including the Upstate and Columbia areas face minimal hurricane risk, with annual premiums typically between $1,200 and $2,000 for quality coverage. New construction earns better rates because modern building codes require stronger roof attachments and updated electrical systems reducing claim probability. The state hasn't experienced the insurance market crisis affecting Florida, meaning coverage remains available from major carriers at stable rates.

Flood insurance requirements affect coastal properties in FEMA-designated zones. These policies add $800 to $2,800 annually depending on elevation and specific flood risk. Many new construction communities in coastal areas engineer properties above base flood elevation to minimize or eliminate flood insurance requirements, a selling point worth investigating when comparing similar neighborhoods.

Utility costs favor new construction substantially due to South Carolina's climate requiring significant air conditioning from May through September. Older homes with outdated HVAC systems and poor insulation can see summer electric bills exceeding $260 monthly for 2,500 square foot homes. New construction with modern insulation standards, efficient HVAC systems, and better window technology typically runs 30% to 35% lower for comparable square footage. Duke Energy and Santee Cooper serve most of the state with relatively stable rates, though costs have risen following nuclear plant construction cost overruns.

HOA fees vary by community type and location. Most single-family communities charge $45 to $110 monthly for basic lawn maintenance and common area upkeep. Master-planned communities with amenities including pools and fitness centers can reach $150 to $280 monthly. Coastal condo communities often charge $250 to $500 monthly covering building insurance, exterior maintenance, and reserves. Gated communities add security costs. These represent permanent fixed costs that typically increase 3% to 5% annually.

Housing costs vary significantly by market. Charleston's median new home prices have risen substantially, reflecting the region's growth and limited coastal geography. Greenville and Spartanburg offer middle-ground pricing with excellent value. Columbia provides the state's best affordability for quality properties. Builders have responded to sustained migration with developments across price ranges, though coastal proximity always commands premiums.

What new construction delivers in South Carolina's manufacturing economy

Choosing new construction in South Carolina provides advantages shaped by the state's climate, updated building codes following hurricane experiences, and the practical needs of the manufacturing workforce driving much of the state's growth.

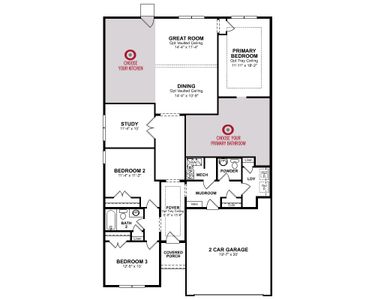

- Modern Layouts Matching Workforce Realities: South Carolina's manufacturing economy includes significant shift work, with Boeing's 787 production running multiple shifts and automotive plants operating around the clock. Floor plans increasingly accommodate these realities with primary suites isolated from other bedrooms, allowing shift workers to sleep during daytime hours without disturbance. Home offices appear routinely for engineers and managers who work hybrid schedules combining plant floor time with remote technical work. Open-concept designs allow families to share space efficiently when shift schedules mean parents and children have limited overlap time. Three-car garages provide vehicle storage plus workspace for tools and projects, recognizing that manufacturing workers often maintain mechanical skills for personal use. Covered outdoor spaces with ceiling fans create genuinely usable areas during South Carolina's hot summers, offering relief from indoor confinement.

- Coastal Building Standards Providing Storm Protection: South Carolina building codes strengthened following Hurricane Hugo in 1989 and subsequent storms. Coastal construction requires wind load resistance, though standards remain less stringent than Florida's most extreme requirements. New homes include hurricane straps securing roof trusses, reinforced garage doors, and impact-resistant windows in high-risk zones. These features provide genuine protection during tropical systems while earning better insurance rates. Coastal foundation requirements address flood risk, with many builders elevating structures above minimum requirements to further reduce insurance costs. Interior moisture management systems including proper ventilation and dehumidification prevent the mold issues that plague older homes in humid climates.

- Energy Efficiency Addressing Climate Realities: South Carolina's summers require substantial air conditioning, making energy efficiency valuable for monthly budget management. New construction with modern insulation, properly sized HVAC systems, Low-E windows, and sealed ductwork delivers utility savings that compound over ownership. A new home using $175 monthly in electricity versus an older home requiring $265 saves $1,080 annually, totaling $32,400 over 30 years. Many builders now include programmable thermostats, ceiling fans as standard features, and radiant barriers in attics reducing cooling loads. Some offer solar panel installation, particularly valuable in coastal areas with high summer cooling demands.

- Updated Technology Infrastructure for Modern Work: Manufacturing professionals and remote workers require reliable internet for technical documentation, video conferencing with global teams, and large file transfers. New construction includes structured wiring providing strong connectivity throughout homes, eliminating dead zones that plague older construction. Electrical capacity accommodates electric vehicle charging, increasingly relevant as Volvo's EV production and broader automotive electrification influence consumer vehicle choices. Smart home systems integrate more seamlessly when infrastructure is planned during construction rather than retrofitted later.

- Warranty Protection Valuable for Busy Professionals: Shift workers and manufacturing professionals often lack time or inclination for home maintenance and repairs. Builder warranties covering structural issues for 10 years, major systems for 2 to 5 years, and workmanship for the first year eliminate repair risks that frequently affect older home buyers. Given South Carolina's humidity and potential for foundation settlement on coastal soils, this warranty coverage provides peace of mind particularly valuable for buyers without construction experience or time to manage contractors.

How construction schedules work in South Carolina

The timeline from contract to closing in South Carolina follows patterns affected by the state's climate, permitting processes, and regional building practices that create specific considerations for buyers.

For inventory homes where construction has progressed to interior finishing, closings typically happen within 50 to 85 days depending on remaining work and loan processing. South Carolina's permitting involves county building departments with varying efficiency levels. Charleston County manages high volume requiring longer approval times, while rural counties often process permits faster. Coastal construction faces additional inspections verifying flood elevation compliance and hurricane provisions. These regulatory layers can extend timelines compared to states with simpler approval processes.

For to-be-built homes where you're selecting lots before site work begins, realistic expectations run 8 to 12 months in most South Carolina markets. The construction sequence breaks into phases that weather affects predictably. Site preparation including lot clearing, utility connections, and foundation excavation takes 2 to 5 weeks depending on lot conditions. Coastal lots sometimes require additional fill or elevation work extending this phase. Foundation work takes 3 to 4 weeks. Framing and roof installation consume 6 to 10 weeks. Rough-in work for plumbing, electrical, and HVAC takes 3 to 4 weeks. Insulation, drywall, and interior finishing require 8 to 13 weeks. Final landscaping and punch list items add 2 to 3 weeks.

Summer weather creates the most significant disruptions. Afternoon thunderstorms from June through September are nearly daily occurrences in coastal areas, limiting exterior work to morning hours and creating cumulative delays. Hurricane season from June through November brings potential for major disruptions when tropical systems approach. Even when storms don't directly hit South Carolina, contractors often secure job sites and halt work when storms threaten anywhere in the Southeast, as materials and crews get redirected to areas needing emergency repairs. Major hurricanes affecting the Carolinas can delay construction for weeks across entire regions as the industry prioritizes recovery over new construction.

Winter generally provides the best construction weather, with moderate temperatures and less precipitation than summer. However, occasional cold snaps can slow concrete work when temperatures drop below freezing, particularly in the Upstate where winter weather patterns differ from coastal areas.

Supply chain issues specific to coastal construction occasionally emerge. Impact-resistant windows, specialized roofing materials, and flood-rated mechanical systems sometimes carry longer lead times than standard products. Choosing readily available materials from builder standard options rather than special orders can reduce completion timelines by three to six weeks.

Contracts should address weather delays while protecting against indefinite extensions. Reasonable contracts might allow 30-day extensions for documented weather events including named storms or flooding, while capping total weather-related delays at 60 days. Negotiate specific builder notification requirements when delays occur and consider requesting daily penalties or cancellation rights if timelines exceed negotiated caps. Builders resist penalty clauses, but leverage exists in slower markets or on inventory that has sat unsold for 90-plus days.

The pre-closing walkthrough scheduled 3 to 5 days before closing represents your final opportunity to document issues before taking ownership. Test all appliances and mechanical systems. Run water in every fixture checking drainage and hot water delivery. Verify HVAC reaches set temperatures in all rooms. Examine caulking around windows, doors, and tubs where water intrusion commonly occurs. Check exterior grading to ensure water flows away from the foundation. For coastal properties, verify garage door operation and sealing. Look for any moisture signs including water stains or musty odors. Document issues with photos and written descriptions. Problems identified during walkthrough become the builder's responsibility to address before closing or through a detailed punch list with completion dates you approve before signing closing documents.

Financing considerations in South Carolina's moderate-cost environment

New construction financing in South Carolina requires understanding how the state's property tax structure affects qualification and managing interest rate protection across construction timelines.

Most production builders maintain preferred lender relationships with regional banks and national mortgage companies understanding their construction processes. Using preferred lenders typically unlocks incentives including closing cost credits ranging from $4,500 to $12,000, appraisal fee waivers, and occasionally rate concessions of 0.125%. These combined benefits can total $8,000 to $15,000 in real savings. However, compare at least three lenders including one outside the builder's network to ensure competitive terms. Request detailed loan estimates showing all fees and effective APR rather than just headline interest rates.

South Carolina's low property taxes create a qualification advantage compared to higher-tax states. On a $380,000 home with $190 monthly property tax, your total housing payment including principal, interest, taxes, and insurance might reach $2,650 monthly. This lower payment allows you to qualify for higher loan amounts compared to states like Texas or New Jersey where the same home might carry $650 to $800 monthly in property taxes. However, the state's 6.5% income tax does reduce your take-home pay compared to zero-tax states, partially offsetting the property tax advantage.

Rate locks matter when construction timelines extend 8 to 12 months. Some builders offer extended lock programs holding your rate through construction, typically adding 0.25% to 0.375% to your rate. Other lenders provide float-down options allowing you to capture lower rates if markets improve, usually for upfront fees of $750 to $1,200. The protection math remains significant. A 1% rate increase on a $350,000 loan adds approximately $210 monthly, or $2,520 annually. Over 30 years, that's $75,600 in additional interest. Paying 0.25% extra upfront for lock protection costs roughly $53 monthly on the same loan, totaling $636 annually. If rates increase even 0.5% during construction, the protection pays for itself.

Most South Carolina lenders use single-close construction loans where financing converts automatically when construction completes. Verify your lender's structure and understand exactly when rate locks expire and how extensions work if weather delays push your closing date. Some builders offer rate lock extension guarantees if delays result from hurricanes or tropical storms rather than construction management issues, protecting you from paying additional costs due to weather beyond anyone's control.

Down payment requirements range from 3% to 20% depending on loan type and financial profile. VA loans require zero down payment, making them particularly attractive for military buyers near Joint Base Charleston. Some builders offer down payment assistance in slower markets, sometimes reducing requirements to 1% or providing credits effectively lowering cash needed. These programs trade off against higher rates or less price negotiability.

Flood insurance requirements affect coastal properties in FEMA zones. If you're using a mortgage and the property falls in a designated flood zone, flood insurance is mandatory. Annual costs range from $800 to $2,800 depending on elevation and specific risk. This becomes part of your escrow payment affecting qualification calculations. Some builders advertise properties "not requiring flood insurance" because they've engineered them above base flood elevation, a valuable consideration when comparing coastal communities.

Why specialized representation matters in South Carolina

South Carolina's manufacturing economy, diverse regional markets, and coastal considerations make specialized buyer representation valuable for navigating new construction effectively, particularly for buyers relocating from out of state for aerospace or automotive positions.

Sales representatives at model homes work for builders with compensation tied to selling their inventory at maximum prices with minimal concessions. They know their communities and floor plans thoroughly but provide no assistance comparing against competing builders or protecting your interests during negotiations. In Charleston's hot market, these representatives often employ pressure tactics including artificial deadlines because demand supports aggressive approaches. In slower Upstate markets or Columbia, they may negotiate more flexibly but still represent the builder exclusively.

Independent buyer's agents represent your interests throughout the process. These professionals help identify which communities offer best value relative to your priorities, evaluate commute times to Boeing or Volvo facilities, compare builder reputations for quality and warranty responsiveness, and ensure contract terms protect you during construction and closing. South Carolina agents specializing in new construction typically maintain expertise in specific regions rather than attempting to cover the entire state uniformly.

Agent compensation comes from builders through co-op commission, typically 2.5% to 3% of purchase price, meaning representation doesn't increase your cost beyond what you'd pay buying directly. The value appears in better negotiated terms, avoided expensive mistakes, and informed decisions affecting your investment for years. In South Carolina particularly, agents familiar with coastal flooding can evaluate elevation certificates and identify properties with concerning flood risk that will create ongoing insurance expense problems. They recognize builders with strong reputations versus those with recurring quality complaints or financial instability.

Regional expertise matters in a state where markets differ dramatically. A Charleston specialist understands aerospace employment patterns, coastal flooding nuances, and hurricane preparation requirements but may have limited knowledge of Upstate manufacturing dynamics or Greenville's emerging urban culture. A Greenville agent familiar with automotive industry shift schedules and mountain proximity might not recognize Charleston's military housing patterns or understand coastal insurance complexities. Ensure your representation has genuine expertise in the specific region where you're searching rather than assuming South Carolina experience translates uniformly.

The contract review process represents where agent expertise delivers particular value. South Carolina purchase agreements for new homes often run 25 to 45 pages with builder-favorable terms. Experienced agents identify problematic clauses including vague completion timelines, broad force majeure provisions allowing indefinite hurricane delays, limited remedies for builder default, and warranty limitations that exclude common issues. They negotiate modifications protecting you or ensure you understand exactly what risks you're accepting. Given coastal flooding potential and hurricane disruption possibilities, having representation that understands what constitutes reasonable weather delay provisions versus builder-favorable loopholes becomes particularly valuable for protecting your interests and timeline expectations.

Where can I find new homes?

Browse currently available new construction homes, communities, and floor plans across the South Carolina. All listings are updated daily with the latest inventory from builders. Browse all communities & new homes in South Carolina

Explore other states in the Southeast

Florida2,284 communities150% more than in South Carolina34,381 homes257% more than in South Carolina$422,000 home median price

Florida2,284 communities150% more than in South Carolina34,381 homes257% more than in South Carolina$422,000 home median price Georgia951 communities4% more than in South Carolina10,147 homes5% more than in South Carolina$469,990 home median price

Georgia951 communities4% more than in South Carolina10,147 homes5% more than in South Carolina$469,990 home median price North Carolina1,250 communities37% more than in South Carolina16,827 homes75% more than in South Carolina$400,000 home median price

North Carolina1,250 communities37% more than in South Carolina16,827 homes75% more than in South Carolina$400,000 home median price

Top-rated new construction communities in South Carolina

Master planned communities in South Carolina

Real estate in South Carolina

The real estate market in South Carolina is both stable and diverse, with the average home selling for $288,816 (source: Zillow). There are currently two programs that provide down payment assistance which are the SC Housing Homebuyer Program and the Palmetto Home Advantage Program. SC Housing offers both programs and helps borrowers obtain affordable 30-year-fixed-rate mortgages, making it easier for first-time buyers to own their own homes (Source: SC Housing). Charleston's real estate market is characterized by its well-preserved historical properties and luxurious waterfront homes. Columbia, the state capital, offers a mix of urban residences and suburban properties, catering to both the young professional and the growing family. Greenville's real estate market continues to boom, with new developments cropping up regularly. The city's revitalized downtown, filled with shopping, dining, and arts venues, has become a main draw for buyers.

Newly released communities

Recently listed homes

Recently published floor plans

The most popular new construction builders in South Carolina

Want to learn more about new construction?

Frequently asked questions

What is the current median sale price for a property in South Carolina?

The real estate market in South Carolina, as of December 2025, shows a median sale price of $327,900 for properties. This figure includes a selection of 9614 new homes constructed by 64 developers.

Who are the major developers of new construction homes in South Carolina?

South Carolina's real estate market offers many new construction options, with D.R. Horton, Lennar, Mungo Homes, Great Southern Homes and Dream Finders Homes as the main developers. These builders create communities suited to modern living.