New construction in North Carolina: prices, trends, guides & homes as of December 2025

About North Carolina

Let's talk about North Carolina, the state that has it all. Located in the southeastern United States, North Carolina is home to many natural wonders. From the scenic Blue Ridge Mountains in the west to the pristine beaches of the Outer Banks in the east, there is plenty to see for people who enjoy being outdoors. There are also multiple vibrant cities, including Raleigh, Durham, and Charlotte. These cities are home to thriving arts and culture scenes, excellent restaurants, and bustling downtown areas. With a population of approximately 10.5 million people, North Carolina is the ninth most populous state in the county. Its economy is diverse, with major industries including finance, technology, and agriculture. In addition to its natural beauty and thriving cities, North Carolina has a rich history and culture. The state played a crucial role in the American Revolution and the Civil war. It contains many historical sites and museums offering fascinating insights into the past. Of course, we can't forget about North Carolina's food. If you're a barbecue fan, you're in the right place. But that's not all - North Carolina is also known for its seafood, sweet potato dishes, and other deliciousness, making it a foodie's paradise. Overall, North Carolina is diverse and vibrant, offering something for everyone ranging from outdoor enthusiasts to history buffs.

How are new home prices changing in North Carolina?

Home price data reflects current listings in North Carolina, sourced from Jome and updated regularly

*Based on Jome markets

Chat with North Carolina Expert

Get a free, no-pressure consultation with our top North Carolina new-construction expert. They know every major builder, the best deals and incentives, and exactly what's happening in the local new-construction market.

North Carolina market overview

- Overall inventory16,827

- Single-family inventory13,889

- Townhouse inventory2,494

- Condo inventory270

- Multi-family inventory82

- Penthouse inventory0

- 1 bed inventory62

- 2 beds inventory670

- 3 beds inventory8,368

- 4+ beds inventory7,717

- Median home price$400,000

- Median sqft price$200.21

- Median 1 bed price$305,000

- Median 2 beds price$429,000

- Median 3 beds price$357,000

- Median 4+ beds price$469,990

- Min listing price$125,000

- Max listing price$14,999,000

- Min community price$199,900

- Max community price$9,500,000

North Carolina median price change

| Month | Median price | Change |

|---|---|---|

| December 2025 | $401,550.5 | - |

What it's like to live in North Carolina?

North Carolina operates as three distinct economic regions that happen to share state boundaries. Charlotte anchors the western Piedmont as a major banking and financial services center, with Bank of America's iconic corporate headquarters and Wells Fargo's East Coast operations employing tens of thousands in glass towers that define the uptown skyline. The Research Triangle in the central Piedmont encompasses Raleigh, Durham, and Chapel Hill, forming one of the nation's most concentrated tech and research ecosystems around major universities and companies including Cisco Systems, SAS Institute, and Lenovo's North America headquarters. The eastern coastal plain serves military installations, agriculture, and emerging manufacturing. The mountains in the far west attract retirees and tourism. The common thread is North Carolina's moderate tax structure, four-season climate without extremes, and business environment that has attracted sustained corporate relocations and population growth for three decades despite recent political controversies that periodically make national headlines.

Why North Carolina attracts corporate America and tech talent

The economic case centers on two distinct but complementary engines. Charlotte's transformation into America's second-largest banking center after New York creates massive white-collar employment. Bank of America's headquarters building anchors uptown Charlotte, employing thousands in finance, investment banking, wealth management, and corporate operations. Wells Fargo's East Coast headquarters at 550 South Tryon Street supports multimillion-dollar office investment and a growing workforce in consumer banking and mortgage operations. Truist Financial, formed from the merger of BB&T and SunTrust, maintains significant Charlotte presence. These banking giants create employment density extending beyond direct bank employees to include lawyers, accountants, consultants, and professional services firms serving the financial sector. Charlotte Douglas International Airport's position as American Airlines' second-largest hub facilitates the business travel that banking requires, while also serving as a major employer in its own right.

The Research Triangle Park represents one of the most successful planned technology centers globally, spanning 7,000 acres between Raleigh, Durham, and Chapel Hill. Cisco Systems operates an innovative tech campus in the area, providing networking and technology infrastructure jobs. SAS Institute's LEED-Gold headquarters in Cary anchors the region's analytics and data science sector, with on-site daycare and research facilities creating a corporate campus that employees rarely want to leave. Lenovo's North America operational headquarters in Morrisville brings global technology company presence to the Triangle. Beyond these anchor tenants, hundreds of smaller tech companies, biotech startups, pharmaceutical operations, and research firms cluster around the park, creating an ecosystem that feeds off Duke, UNC, and NC State universities' research output and graduate talent pipelines. The concentration of PhD-level researchers, software engineers, and scientists creates intellectual density rivaling Boston or the Bay Area at dramatically lower costs.

Manufacturing has evolved from North Carolina's textile past into advanced operations including automotive, aerospace, and pharmaceutical production. The state attracts companies seeking lower costs than northern alternatives while maintaining reasonable proximity to East Coast markets and ports. Furniture manufacturing remains significant despite offshoring pressures, with High Point still functioning as a major industry center.

Military installations provide employment stability across multiple regions. Fort Liberty (formerly Fort Bragg) in Fayetteville ranks among the Army's largest installations, employing over 50,000 active-duty personnel plus thousands of civilian contractors and support staff. Marine Corps Base Camp Lejeune and Marine Corps Air Station Cherry Point in eastern North Carolina serve similar functions. Seymour Johnson Air Force Base near Goldsboro anchors another military community. Charlotte Air National Guard Base at the airport supports military personnel with westside access to the city. These installations create housing demand in specific markets and provide economic stability through defense spending that continues regardless of broader economic conditions.

The university presence shapes entire metros. UNC-Chapel Hill, Duke, and NC State in the Triangle create college town culture, employ thousands in academic and administrative positions, and generate startup companies from research projects. Charlotte has built out its own university presence with UNC Charlotte growing into a major institution. These universities create stable employment, cultural amenities unusual for mid-sized metros, and constant influx of young talent that companies recruit into permanent positions.

The tax structure sits in moderate territory. North Carolina charges flat state income tax at 4.5% after recent reductions from higher brackets, landing below northeastern states while above zero-tax states like Florida and Tennessee. Property taxes remain reasonable, with effective rates typically between 0.70% and 0.95% of assessed value depending on county, lower than New Jersey or Illinois but somewhat higher than South Carolina. The combined burden creates competitive positioning for recruiting from higher-tax states while remaining livable for residents.

The cost of living varies by metro and proximity to employment centers. Charlotte's urban core and close-in suburbs have appreciated substantially, with quality new construction often exceeding $450,000 in desirable areas. The Triangle offers similar pricing in prime locations near Research Triangle Park and top school districts. Outer suburbs and secondary markets provide better value, with new construction from $310,000 to $420,000 in workable locations. Smaller metros including Greensboro, Winston-Salem, and Asheville each serve specific demographics at varying price points.

The climate delivers four genuine seasons without the harsh extremes that northern states endure or the relentless heat that defines the Deep South. Summers run hot and humid, with temperatures regularly reaching the upper 80s to low 90s from June through August. Winters bring occasional snow, particularly in the Piedmont and mountains, though sustained arctic cold remains rare and infrastructure-paralyzing ice storms occur only periodically. Spring and fall provide extended periods of genuinely pleasant weather. The mountains offer cooler summers and more winter precipitation, while the coast experiences milder winters and higher humidity.

Understanding North Carolina's markets by buyer profile

North Carolina's economic diversity across finance, technology, military, and university sectors creates distinct buyer profiles concentrated in specific regions, with new construction responding to sustained migration from higher-cost states and corporate relocations.

For Banking and Financial Services Professionals: Charlotte dominates this segment almost exclusively, attracting investment bankers, wealth managers, financial analysts, risk management specialists, and corporate banking executives working at Bank of America's headquarters, Wells Fargo's East Coast operations, or the numerous smaller financial firms clustering around these giants. These professionals earn substantial salaries, typically $85,000 to $300,000-plus depending on seniority and specific roles, creating demand for quality housing within reasonable commutes to uptown Charlotte. New construction in South Charlotte, Ballantyne, Waxhaw, and Union County serves this demographic, with price points ranging from $450,000 to $850,000 for properties balancing commute times with space and top-rated school districts. Many relocate from New York, where similar positions paid comparable salaries but housing cost double or triple. Financial services work often involves long hours and occasional travel, making proximity to Charlotte Douglas International Airport valuable. These buyers seek modern floor plans with home offices for evening work reviewing deals or preparing presentations, strong internet infrastructure for secure VPN connections to corporate systems, and neighborhoods with other professionals who understand demanding career schedules.

For Technology Workers and Research Professionals: The Research Triangle captures this demographic, attracting software engineers, data scientists, researchers, product managers, and technical specialists working at companies throughout the park and surrounding areas. Cisco Systems employees concentrate in areas offering reasonable commutes to their Durham-area campus. SAS Institute's Cary headquarters draws workers seeking proximity to what many consider one of America's best corporate employers for work-life balance and benefits. Lenovo's Morrisville operations bring workers from various backgrounds including many with international experience or connections to Asia. Beyond these anchors, hundreds of smaller tech companies, biotech firms, and pharmaceutical operations create diverse employment. New construction in Cary, Apex, Morrisville, Holly Springs, and Wake Forest serves this market, with price points ranging from $380,000 to $650,000 depending on specific location and school district quality. Triangle tech workers typically earn less than Bay Area or Seattle counterparts but find North Carolina's housing costs allow better lifestyle balance. Remote tech workers who can work from anywhere increasingly choose the Triangle for the intellectual community, university presence, and moderate costs. These buyers prioritize home offices, strong internet infrastructure, proximity to airports for occasional work travel, and neighborhoods with other educated professionals and good schools.

For Military Families Across Service Branches: Fayetteville's Fort Liberty creates the state's largest military housing market, with active-duty Army personnel, military retirees, and defense contractors supporting the installation. The base's size and the concentration of special operations units create a professional military culture throughout the city. New construction in Fayetteville and surrounding Cumberland County ranges from $260,000 to $420,000, serving military families at various ranks. Junior enlisted personnel often rent initially, while senior NCOs and officers purchase using VA loans with zero down payment requirements. These buyers prioritize short commutes for early morning physical training and unpredictable duty schedules, strong schools providing stability during assignments, and communities with other military families who understand deployment realities. Marine families near Camp Lejeune in eastern North Carolina follow similar patterns. Seymour Johnson Air Force Base near Goldsboro creates smaller but similar demand. Military buyers understand they'll likely PCS (Permanent Change of Station) within a few years, making resale potential and market stability important considerations beyond just personal use.

For University-Connected Professionals and Faculty: The Triangle's university presence creates demand from professors, administrators, researchers, and graduate students with families seeking homeownership. Duke, UNC-Chapel Hill, and NC State each anchor distinct submarkets. Chapel Hill and Carrboro serve UNC faculty, though costs have risen substantially making these among the Triangle's most expensive areas. Durham's revitalization attracts Duke-affiliated buyers seeking urban walkability. Raleigh's western suburbs near NC State provide more affordable options. New construction serving this demographic ranges from $360,000 to $580,000 depending on specific location. Academic schedules and research commitments create unique considerations, with faculty often requiring home offices for writing and grading, while flexible schedules allow midday commutes avoiding rush hour congestion. Charlotte's UNC Charlotte creates similar but smaller demand patterns. These buyers prioritize intellectual community, proximity to cultural amenities universities provide, and school quality for families.

For Corporate Relocators From Northern Markets: Both Charlotte and the Triangle attract substantial corporate relocation from companies moving operations from higher-cost northern states or relocating individual employees to lower-cost markets. These buyers often bring housing budget expectations from their departure cities, finding North Carolina's prices accessible despite local complaints about appreciation. Finance professionals relocating from New York, tech workers from Boston or New Jersey, and pharmaceutical executives from Connecticut or Pennsylvania drive demand in premium submarkets. New construction in top school districts near major employment centers serves this demographic at price points from $480,000 to $750,000, which these buyers often view as bargains compared to where they're leaving. They seek modern finishes, master-planned communities with amenities replacing urban infrastructure they're leaving behind, and neighborhoods with other educated transplants rather than multi-generational North Carolina families.

For Growing Families Prioritizing Education: School district quality drives decisions for families with children throughout both Charlotte and Triangle metros. Wake County schools in the Triangle maintain generally strong reputations, though quality varies by specific school. Cary's portion of Wake County consistently ranks among the state's best. Chapel Hill-Carrboro City Schools perform well but at corresponding price premiums. In Charlotte, specific areas within Charlotte-Mecklenburg Schools perform strongly despite broader district challenges. Union County's schools attract families seeking quality at somewhat lower costs than close-in Charlotte suburbs. New construction communities position strategically within high-performing zones where possible, though North Carolina's assignment policies and magnet school systems create complexity requiring families to research specific schools rather than relying on district-wide reputations. These buyers prioritize location over square footage, accepting smaller floor plans to secure addresses within boundaries that protect long-term resale value. Price points range from $420,000 in decent but not premium zones to $650,000-plus in top-rated elementary school areas where attendance boundaries command maximum premiums.

For Retirees Seeking Four-Season Climate and Lower Costs: North Carolina attracts retirees from northeastern and midwestern states seeking milder winters, four-season variety, and costs below coastal alternatives. Asheville and the mountain region serve affluent retirees drawn to scenic beauty, outdoor recreation, and progressive culture unusual in southern states. The Triangle attracts retirees seeking university town intellectual stimulation and cultural amenities. Charlotte serves retirees wanting urban energy and major airport access. Smaller metros including Wilmington's coast and Pinehurst's golf communities serve specific lifestyle preferences. New construction for retirees ranges from $320,000 in modest communities to $650,000-plus in premium locations. These buyers seek single-story layouts, master-on-main configurations, and communities with lawn maintenance services. Access to quality healthcare matters increasingly with age, with Charlotte's major hospital systems, the Triangle's academic medical centers at Duke and UNC, and Asheville's regional facilities serving as draws.

For First-Time Buyers Seeking Entry Points: Charlotte's and the Triangle's rapid appreciation has pushed first-time buyers to outer suburbs where commutes stretch beyond 40 minutes but prices remain accessible. In Charlotte, areas like Gastonia, Monroe, and Concord's outskirts offer new construction from $290,000 to $350,000. In the Triangle, Clayton, Fuquay-Varina, and Youngsville provide entry points at similar pricing. Smaller metros including Greensboro, Winston-Salem, and Durham's eastern edges offer even better value. These buyers maximize square footage over location, often purchasing 2,000 to 2,500 square foot homes that would cost $120,000 more in prime Charlotte or Triangle locations. Many are relocating from higher-cost states, making even distant North Carolina suburbs feel accessible compared to alternatives in their departure markets.

The real costs beyond your mortgage payment

Your actual monthly housing expense in North Carolina extends beyond principal and interest, with the state's cost structure creating specific considerations that vary by location and require evaluation before committing.

Property taxes vary by county and municipality, with some variation across the state's diverse regions. The average effective rate runs approximately 0.70% to 0.95% of assessed value, though this masks county-level differences. Wake County (Raleigh area) typically runs around 0.85% to 0.95% depending on municipality. Mecklenburg County (Charlotte) sits at similar levels. Durham County carries rates in the same range. Counties outside major metros often charge somewhat less. On a $430,000 home, expect annual tax bills ranging from roughly $3,010 to $4,085. North Carolina reassesses properties periodically rather than annually, creating stability in tax bills between reassessment years but potential jumps when reassessments occur. Homestead exemptions provide limited relief for elderly or disabled homeowners meeting specific criteria, though the state offers less generous exemptions than some southeastern alternatives.

State income tax at a flat 4.5% applies to wages and investment income, representing a reduction from previous graduated rates that topped at 7.75%. While higher than zero-tax states like Florida and Tennessee, the flat rate lands well below northeastern states and California. The combined state and local tax burden positions North Carolina competitively for recruiting from higher-tax regions while remaining moderate for residents.

Sales tax across the state ranges from 6.75% to 7.5%, with the state collecting 4.75% and counties adding 2% to 2.75%. This affects major purchases including vehicles, where a $46,000 SUV carries $3,105 to $3,450 in sales tax. Furniture, appliances, and building materials all include this premium, appearing quickly when furnishing a new home.

Homeowner's insurance costs run moderate compared to coastal states prone to hurricanes, though North Carolina's coast does face Atlantic storm risk creating regional variation. Inland properties in Charlotte and the Triangle typically see annual premiums ranging from $1,300 to $2,200 for standard single-family homes depending on coverage levels and home value. Coastal properties face higher premiums accounting for hurricane and wind damage risk, sometimes reaching $2,500 to $4,000 annually depending on specific location and proximity to water. Mountain properties may face slightly different rate structures accounting for wildfire risk in certain areas. New construction earns better rates because modern building codes require stronger construction and updated systems reducing claim probability. The state maintains a relatively stable insurance market without the crisis conditions affecting Florida or Louisiana.

Flood insurance requirements affect properties in FEMA-designated zones, more common in coastal areas and properties near rivers throughout the state. These policies add $700 to $2,500 annually depending on elevation and specific risk. Many new construction communities engineer properties above base flood elevation where applicable, minimizing or eliminating flood insurance requirements.

Utility costs favor new construction due to North Carolina's climate requiring both heating and cooling. Four-season weather means HVAC systems must handle both functions competently. Older homes with outdated systems and poor insulation can see combined monthly utility bills exceeding $240 during summer cooling peaks and winter heating demands. New construction with modern insulation standards, efficient HVAC systems, and better window technology typically runs 30% to 35% lower for comparable square footage. Duke Energy and Dominion Energy serve most of the state with rates that have risen but remain generally competitive. Natural gas availability varies by location, with some areas relying on propane or all-electric systems.

HOA fees vary by community type and region. Most single-family communities charge $50 to $140 monthly for basic lawn maintenance, common area upkeep, and amenity access. Master-planned communities with extensive facilities including pools, fitness centers, and trails can reach $180 to $320 monthly. Townhome communities typically range from $170 to $300 monthly covering exterior maintenance and reserves. Age-restricted communities serving retirees often carry higher fees funding enhanced amenities and activities. These represent permanent fixed costs that increase 3% to 6% annually.

Housing costs vary significantly by metro and proximity to employment centers. Charlotte's prime suburbs and the Triangle's Research Triangle Park-adjacent areas command premium prices. Outer suburbs and secondary markets provide better value. Smaller metros offer the state's best affordability but with fewer employment options.

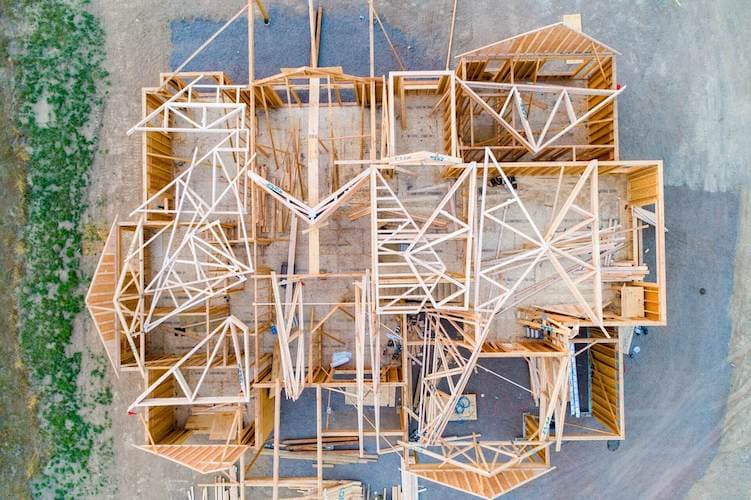

What new construction delivers in North Carolina's diverse climate

Choosing new construction in North Carolina provides advantages shaped by the state's four-season climate, updated building codes, and the practical needs of the educated workforce driving much of the state's growth in finance and technology sectors.

- Modern Floor Plans Matching Professional Lifestyles: North Carolina's concentration of white-collar professionals in banking, technology, and research creates specific expectations about home functionality. Floor plans increasingly include dedicated home offices with French doors, recognizing that many professionals maintain hybrid schedules combining office attendance with remote work days. Financial services professionals often review documents and prepare presentations at home during evenings. Tech workers participate in video calls with distributed teams across time zones. Researchers write papers and analyze data outside lab environments. Open-concept designs connecting kitchens to living areas have become standard. Primary suites now include spa-style bathrooms with separate tubs and showers, dual vanities, and walk-in closets that older homes can't accommodate without expensive renovations. Mudrooms with built-in storage appear routinely in floor plans above 2,200 square feet. Covered outdoor spaces with ceiling fans create usable areas during North Carolina's pleasant spring and fall seasons.

- Four-Season Construction Standards: North Carolina's climate requires homes that handle both cooling and heating effectively, unlike single-climate regions. New construction incorporates insulation standards addressing both heat retention during winter and heat rejection during summer. HVAC systems are sized to handle both functions, something older homes sometimes got wrong by over-sizing for one season while under-sizing for the other. Modern construction includes proper moisture barriers particularly important in humid Piedmont summers, preventing the mold issues that plague older homes. Windows must address both summer solar heat gain and winter heat loss, with Low-E coatings and proper sealing reducing energy transfer. Foundation systems address North Carolina's clay soils, which can shift with moisture content changes, using techniques that minimize future settlement issues. Roof systems must handle occasional heavy snow loads in the mountains and Piedmont while also managing summer heat and the periodic severe thunderstorms that affect the state.

- Energy Efficiency Across Seasons: North Carolina's four-season climate makes energy efficiency valuable year-round rather than just during one extreme season. New homes with modern insulation, efficient HVAC systems, properly sealed ductwork, and better window technology deliver utility savings that compound over ownership. A new home using $165 monthly in combined heating and cooling versus an older home requiring $245 saves $960 annually, totaling $28,800 over 30 years. Many builders now include programmable thermostats allowing different settings for occupied versus unoccupied periods, ceiling fans reducing perceived temperature and allowing higher cooling setpoints, and improved attic ventilation reducing summer heat loads. Some offer solar panel installation as upgrades, though North Carolina's moderate climate makes the payback period longer than in extreme-heat states like Arizona.

- Technology Infrastructure for Knowledge Workers: Banking professionals, tech workers, and researchers require reliable technology infrastructure. New construction includes structured wiring providing strong WiFi coverage throughout homes, eliminating dead zones that plague older construction with thick walls and complex floor plans. Electrical capacity accommodates multiple computers, monitors, printers, and other office equipment without circuit overload. Smart home systems integrate seamlessly when infrastructure is planned during construction. Home security systems, which many corporate relocators from urban areas expect as standard, can be pre-wired rather than retrofitted. Garage electrical supports electric vehicle charging, increasingly relevant as educated professionals working in corporate environments adopt EVs at higher rates than general population.

- Comprehensive Warranty Protection for Busy Professionals: Banking professionals working long hours and tech workers managing demanding project schedules often lack time for home maintenance and repairs. Builder warranties covering structural issues for 10 years, major systems for 2 to 5 years, and workmanship for the first year eliminate repair risks that affect older home buyers. Given North Carolina's potential for foundation movement on clay soils, HVAC issues during temperature extremes, and moisture-related problems in humid seasons, warranty coverage provides peace of mind particularly valuable for corporate relocators without established local contractor networks or construction knowledge to evaluate quality issues.

How construction timelines work in four-season climate

The path from contract signing to receiving keys in North Carolina involves phases affected by the state's weather patterns, permitting processes in multiple growing metros, and building practices that create specific considerations for buyers coordinating moves with employment start dates or school schedules.

For inventory homes where construction has progressed to interior finishing, closings typically happen within 50 to 85 days depending on remaining work and loan processing. Charlotte and Raleigh's permitting departments manage high volumes as these metros continue rapid growth, sometimes creating delays when departments face backlogs. Wake County, Mecklenburg County, and surrounding jurisdictions each have independent permitting processes with varying efficiency. Smaller counties generally process permits faster but with correspondingly less sophisticated review processes. Final inspections must occur before closing, with scheduling sometimes creating delays during peak building seasons when inspection departments struggle with workload.

For to-be-built homes where you're selecting lots before site work begins, realistic expectations run 8 to 12 months in most North Carolina markets. The construction sequence breaks into phases that weather affects predictably. Site preparation including lot clearing, utility connections, and foundation excavation takes 2 to 5 weeks depending on lot conditions. North Carolina's clay soils require specific foundation approaches, sometimes extending this phase when soil conditions prove challenging or when rocky substrates require additional excavation. Foundation work takes 3 to 4 weeks. Framing and roof installation consume 6 to 10 weeks. Rough-in work for plumbing, electrical, and HVAC takes 3 to 4 weeks. Insulation, drywall, and interior finishing require 8 to 13 weeks. Final landscaping and punch list items add 2 to 4 weeks.

Weather creates seasonal construction patterns. Spring brings the most disruption, with March through May experiencing significant rainfall that can turn job sites into mud pits, halting foundation work and exterior construction until sites dry sufficiently for equipment operation and safe work. Summer heat and humidity stress crews and slow productivity during peak afternoon hours, though conditions rarely reach the extreme levels that southern and southwestern states endure. Summer thunderstorms provide brief but regular disruptions to exterior work. Fall generally provides the best construction weather, with moderate temperatures, less precipitation, and comfortable working conditions allowing maximum productivity. Winter brings occasional challenges, particularly in the Piedmont and mountains where ice and snow can halt work for days at a time. While sustained freezing remains less common than northern states, the unpredictability of winter weather creates planning challenges. February typically brings milder conditions signaling spring's approach.

Supply chain issues have largely resolved following pandemic-era disruptions, but specific materials still carry lead times. Custom windows, specialized tile selections, and high-end appliances can add 3 to 6 weeks to construction schedules. Choosing readily available materials from builder standard options reduces completion timelines compared to special orders.

North Carolina contracts should address weather delays while protecting against indefinite extensions. Reasonable contracts might allow 30-day extensions for documented severe weather including major storms, flooding, or extended periods where site conditions prevent safe work, while capping total weather-related delays at 60 days. Negotiate specific builder notification requirements when delays occur and consider requesting remedies including daily penalties or cancellation rights if delays exceed caps. In Charlotte and Triangle's competitive markets where inventory moves quickly, builders have less incentive to negotiate favorable terms. In slower markets or during economic downturns, leverage exists for negotiating buyer-favorable provisions.

The pre-closing walkthrough scheduled 3 to 5 days before closing represents your final opportunity to document issues before taking ownership. Test both heating and cooling functions of HVAC systems, as four-season climate requires both to work properly. Set heat several degrees above current temperature and verify all rooms warm adequately, then test cooling similarly. This matters more than single-climate regions where only one function gets regular use. Run water in all fixtures checking for proper drainage and hot water delivery. Examine caulking around windows, doors, tubs, and showers where water intrusion commonly occurs during North Carolina's rainy springs. Check that exterior grading slopes away from the foundation to prevent water pooling. Look for any moisture signs including water stains or musty odors that might indicate construction-phase leaks. Test all appliances. Verify garage door operation and weather sealing. Document any issues with photos and written descriptions. Problems identified during walkthrough become the builder's responsibility to address before closing or through a detailed punch list with specific completion dates you approve before signing closing documents.

Financing considerations in North Carolina's moderate-tax environment

New construction financing in North Carolina requires understanding how the state's tax structure affects qualification and managing interest rate protection across construction timelines that spring weather particularly can extend.

Most production builders maintain preferred lender relationships with regional banks, credit unions, and national mortgage companies understanding their construction processes. Using preferred lenders typically unlocks incentives including closing cost credits ranging from $5,500 to $13,000, appraisal fee waivers, and occasionally rate concessions of 0.125% to 0.25%. These combined benefits can total $10,000 to $16,000 in real savings. However, compare at least three lenders including one outside the builder's network to ensure competitive terms. Request detailed loan estimates showing all fees and effective APR rather than just headline interest rates.

North Carolina's 4.5% flat income tax creates moderate impact on qualification. It reduces take-home pay compared to zero-tax states but lands well below northeastern alternatives. On a $420,000 home with approximately $320 monthly property tax, your total housing payment including principal, interest, taxes, and insurance might reach $3,050 monthly. This creates neither significant advantage nor disadvantage compared to other competitive southeastern states, with qualification depending more on your specific income and debt levels than state tax structure differences.

Rate locks matter when construction timelines extend 8 to 12 months. Some builders offer extended lock programs holding your rate through construction, typically adding 0.25% to 0.375% to your rate as insurance premium. Other lenders provide float-down options allowing you to capture lower rates if markets improve, usually for upfront fees of $850 to $1,350. The protection math remains significant. A 1% rate increase on a $370,000 loan adds approximately $222 monthly, or $2,664 annually. Over 30 years, that's $79,920 in additional interest. Paying 0.25% extra upfront for lock protection costs roughly $56 monthly on the same loan, totaling $672 annually. If rates increase even 0.5% during construction, the protection pays for itself multiple times over.

Most North Carolina lenders use single-close construction loans where financing converts automatically when construction completes. Verify your lender's structure and understand exactly when rate locks expire and how extensions work if weather delays push your closing date. Some builders offer rate lock extension guarantees if delays result from severe weather or documented site conditions beyond their control, protecting you from paying additional lock costs.

Down payment requirements range from 3% to 20% depending on loan type and financial profile. Many corporate relocators to Charlotte's banking sector or Triangle's tech companies bring substantial down payments from selling properties in higher-cost markets, sometimes purchasing with 25% to 40% down or paying cash entirely. VA loans require zero down payment, making them attractive for military buyers near Fort Liberty and other installations. Some builders offer down payment assistance in slower markets, sometimes reducing requirements to 1% or providing credits effectively lowering cash needed at closing.

Why specialized representation matters in North Carolina's competitive markets

North Carolina's rapid growth, multiple distinct metros, and influx of corporate relocators unfamiliar with the state's nuances make specialized buyer representation valuable for navigating new construction effectively and understanding regional differences that significantly affect value and lifestyle.

Sales representatives at model homes work for builders with compensation tied to selling their inventory at maximum prices with minimal concessions. They know their communities thoroughly but provide no assistance comparing against competing builders or protecting your interests during negotiations. In Charlotte's prime suburbs and Triangle's Research Triangle Park-adjacent areas where inventory moves quickly, these representatives often employ pressure tactics including artificial deadlines. In slower markets or outer suburbs, they may negotiate more flexibly but still represent the builder exclusively.

Independent buyer's agents represent your interests throughout the process. These professionals help identify which communities offer best value relative to your priorities, evaluate commute times to specific employment centers like Bank of America's headquarters or Research Triangle Park facilities, compare school district quality within and across counties where assignment policies create complexity, assess builder reputations for quality and warranty responsiveness, and ensure contract terms protect you during construction and closing. Both Charlotte and Triangle markets support numerous agents specializing in new construction, with many maintaining expertise in specific metros or regions rather than attempting to cover the entire state.

Agent compensation comes from builders through co-op commission, typically 2.5% to 3% of purchase price, meaning representation doesn't increase your cost beyond what you'd pay buying directly. The value appears in better negotiated terms, avoided expensive mistakes, and informed decisions affecting your investment for years. In North Carolina particularly, agents familiar with school assignment policies can help you understand how magnet schools, choice programs, and attendance boundaries actually work, as the systems differ from traditional neighborhood school models that buyers from other states expect. They recognize builders with strong reputations for standing behind warranties versus those with histories of fighting legitimate claims. They understand which specific areas within counties offer best value and which carry premiums disconnected from actual advantages.

Regional expertise matters significantly given North Carolina's distinct metros. A Charlotte specialist understands banking industry employment patterns, uptown commute considerations, and the specific school dynamics in Mecklenburg and Union Counties but may have limited knowledge of Triangle tech sector nuances or how Research Triangle Park employment affects different submarkets. A Triangle agent familiar with university-connected communities and tech worker preferences might not recognize Charlotte's banking culture differences or understand military housing patterns near Fort Liberty. Coastal and mountain markets operate independently with their own distinct dynamics. Ensure your representation has genuine expertise in the specific region where you're searching.

The contract review process represents where agent expertise delivers particular value. North Carolina purchase agreements for new homes often run 30 to 50 pages with builder-favorable terms. Experienced agents identify problematic clauses including vague completion timelines, broad force majeure provisions allowing indefinite weather delays, limited remedies for builder default, restrictive change order processes, and warranty limitations excluding common issues. They negotiate modifications protecting you or ensure you understand exactly what risks you're accepting in fast-growing markets where builders sometimes struggle to maintain quality while scaling operations rapidly to meet demand from sustained corporate relocations and population growth.

Where can I find new homes?

Browse currently available new construction homes, communities, and floor plans across the North Carolina. All listings are updated daily with the latest inventory from builders. Browse all communities & new homes in North Carolina

Explore other states in the Southeast

Florida2,284 communities83% more than in North Carolina34,381 homes104% more than in North Carolina$422,000 home median price

Florida2,284 communities83% more than in North Carolina34,381 homes104% more than in North Carolina$422,000 home median price Georgia951 communities24% less than in North Carolina10,147 homes40% less than in North Carolina$469,990 home median price

Georgia951 communities24% less than in North Carolina10,147 homes40% less than in North Carolina$469,990 home median price South Carolina914 communities27% less than in North Carolina9,619 homes43% less than in North Carolina$345,203 home median price

South Carolina914 communities27% less than in North Carolina9,619 homes43% less than in North Carolina$345,203 home median price

Top-rated new construction communities in North Carolina

Master planned communities in North Carolina

Real estate in North Carolina

North Carolina is the place to be if you're looking for a hot real estate market. The state has been experiencing steady growth in recent years, translating into a thriving real estate market. One of the reasons for North Carolina's appeal is its diversity and affordability. The state offers a range of urban and rural areas, and housing costs are lower than the national average. The combination makes North Carolina an attractive option for people of all lifestyles looking for a more affordable cost of living. Just because it's affordable doesn't mean it's lacking in quality. North Carolina offers multiple housing options, from charming historic homes to sleek new builds. And with various amenities available in different areas, there's something for everyone. North Carolina's real estate market will continue to thrive in the coming years, making it an appealing option for buyers and sellers.

Newly released communities

Recently listed homes

Recently published floor plans

The most popular new construction builders in North Carolina

Want to learn more about new construction?

Frequently asked questions

What is the current median sale price for a property in North Carolina?

As of December 2025, property seekers in the North Carolina can expect a median sale price of $388,900. This figure encompasses 16844 newly built residences, each crafted by one of 186 respected builders in the region.

Who are the major developers of new construction homes in North Carolina?

The landscape of new homes in North Carolina is shaped by the work of D.R. Horton, Lennar, Mungo Homes, Adams Homes and True Homes. These developers offer a range of new construction options across the area.