Miami Metropolitan Area new construction market: prices, trends, guides & homes as of December 2025

About Miami Metropolitan Area

Welcome to Miami-Dade, the vibrant heart of South Florida. From the bustling city of Miami to the charming town of Homestead, this diverse region has something available for everyone. With influences from Latin America, the Caribbean, and beyond, Miami has become known as a foodie's paradise. No matter where you go in Miami-Dade County, you'll be greeted with warm hospitality, stunning scenery, and endless entertainment options. Miami-Dade County needs no introduction with its world-famous beaches, lively nightlife, and stunning architecture. It is divided into several regions, including the City of Miami, Miami Beach, Coral Gables, and Homestead. Each of these areas has its own unique character and attractions, from the art-deco buildings of Miami Beach to the upscale shopping and dining atmosphere of Coral Gables. Miami-Dade is the most populous region in Flordia, with over 2.7 million people. The geographic makeup is a major attraction for residents and visitors alike, offering an exciting atmosphere for those who love the outdoors and want to experience all that Florida has to offer. The iconic barrier island of Miami Beach is known as being a playground for the rich and famous with its glamorous hotels, upscale restaurants, and exclusive clubs. But don't worry - residents can take advantage of plenty of activities, such as hanging out at the beach or enjoying a cocktail at one of the bars on Ocean Drive. Once you venture off inland to Hialeah, this bustling city is known for its strong Cuban influence. You can enjoy the delicious food and live music while taking in the colorful artwork everywhere you turn. Last but not least, we have Homestead. This charming town is off the beaten path, but it's well worth the trip. Many locals enjoy visiting the Fruit and Spice Park to sample exotic fruits from around the world. You can also head to the Everglades National Park and see some of Florida's famous wildlife up close.

How are new home prices changing in Miami - Ft. Lauderdale, FL?

Home price data reflects current listings in Miami Metropolitan Area, Florida, sourced from Jome and updated regularly

*Based on Jome markets

Get free consultation with Miami Metropolitan Area expert

Get a free, no-pressure consultation with our top Miami Metropolitan Area new-construction expert. They know every major builder, the best deals and incentives, and exactly what's happening in the local new-construction market.

Miami Metropolitan Area market overview

- Overall inventory4,049

- Single-family inventory1,792

- Townhouse inventory560

- Condo inventory1,553

- Multi-family inventory44

- Penthouse inventory51

- 1 bed inventory331

- 2 beds inventory531

- 3 beds inventory1,222

- 4+ beds inventory1,886

- Median home price$1,895,000

- Median sqft price$958.33

- Median 1 bed price$808,950

- Median 2 beds price$1,795,450

- Median 3 beds price$1,027,000

- Median 4+ beds price$3,437,500

- Min listing price$239,900

- Max listing price$84,000,000

- Min community price$349,990

- Max community price$59,000,000

Miami Metropolitan Area median price change

| Month | Median price | Change |

|---|---|---|

| March 2025 | $1,849,500 | - |

| April 2025 | $1,850,000 | +0.03% |

| May 2025 | $1,749,000 | -5.46% |

| June 2025 | $1,662,397 | -4.95% |

| July 2025 | $1,749,749.5 | +5.25% |

| August 2025 | $1,775,000 | +1.44% |

What are the most popular buyers' searches?

What it's like to live in Miami Metropolitan Area?

The Greater Miami-Fort Lauderdale metro operates as Florida's economic powerhouse and America's gateway to Latin America, where international banking and finance, global trade through Port Miami and Port Everglades, tourism spanning Miami Beach's Art Deco hotels to Fort Lauderdale's Intracoastal waterways, healthcare employment through multiple major hospital systems, technology sector growth in emerging "Silicon Beach," and real estate development create an economy generating over $400 billion annually across a sprawling 6,000-square-mile region. The metro spanning Miami-Dade, Broward, and Palm Beach Counties has absorbed explosive growth becoming America's seventh-largest metro with 6.2 million residents, creating a genuinely international city where over 70% of Miami-Dade residents speak a language other than English at home, where Latin American business executives maintain second homes purchasing condos cash without mortgages, where wealth disparity reaches extremes with Brickell penthouses selling for $15 million while service workers in Homestead commute 90 minutes earning $35,000 annually, and where the combination has transformed South Florida from affordable beach paradise into America's third-most expensive major metro behind only San Francisco and New York. Quality new construction in desirable Fort Lauderdale suburbs now ranges $550,000 to $850,000, Miami suburbs run $480,000 to $750,000, and anything approaching the beach, Brickell, or premium areas commands $800,000 to $2 million-plus, pricing out the working-class and middle-class families who once accessed Florida homeownership. The common thread is Miami-Fort Lauderdale's position as the extreme Florida market, where appreciation exceeding 50% to 70% from 2020 to 2024 in many submarkets created wealth for existing owners while completely eliminating affordability for local workers, where insurance crisis reaches catastrophic levels with annual property premiums of $8,000 to $18,000 for standard single-family homes plus mandatory flood insurance adding another $3,000 to $8,000, where traffic congestion on I-95, Palmetto Expressway, and Turnpike rivals Los Angeles despite Florida's flat terrain offering no geographic constraints to road building, where hurricane risk isn't abstract but certain with direct hits from Andrew (1992), Wilma (2005), Irma (2017), and multiple near-misses demonstrating South Florida's extreme vulnerability, and where the trade-offs involve accepting housing costs, insurance premiums, and traffic that together make Miami one of America's least affordable metros despite Florida's zero income tax, while the international character, year-round warmth, beach access, cultural diversity, Latin American connections, and genuine urban energy create an environment unlike anywhere else in America.

Why international capital and Latin American connections drive unprecedented prices

The Miami-Fort Lauderdale economy's fundamental distinguishing characteristic isn't tourism or retirees—it's the international capital flows and Latin American business connections that create housing demand dynamics unlike other U.S. metros. Wealthy Latin Americans from Venezuela, Colombia, Argentina, Brazil, and other countries have treated Miami real estate as safe-haven investment for decades, purchasing properties with cash to preserve capital during political instability, currency devaluation, or economic crises in home countries. This foreign investment accelerated dramatically over the past 15 years as Venezuelan political collapse, Argentine peso devaluations, and Brazilian corruption scandals drove wealthy families to move assets offshore, with Miami representing the logical destination given proximity, cultural connections, existing Latin American communities, and perception of political and economic stability. The impact on housing markets has been dramatic: when international buyers purchase $2 million condos cash without financing, when they purchase multiple investment properties without needing rental income to cover mortgages, when they view $1.5 million single-family homes as bargains compared to equivalent properties in São Paulo or Buenos Aires, the price discovery mechanisms that operate in normal markets break down entirely. Local workers earning Miami salaries cannot compete with international capital, creating the disconnect where Miami's median household income of $59,000 somehow supports median home prices exceeding $580,000—a ratio that makes no economic sense until recognizing that substantial portions of transactions involve buyers whose income doesn't derive from Miami employment.

The banking and finance sector reflects this international character. Major banks including Citigroup, JPMorgan Chase, Wells Fargo, Bank of America, and HSBC maintain significant Miami operations serving Latin American clients, with private banking and wealth management operations managing billions in assets for international families. Boutique banks and financial services firms specializing in Latin American wealth management employ bankers, wealth advisors, investment professionals, and operations staff earning $85,000 to $300,000-plus depending on seniority and book of business. However, even these high-earning financial professionals struggle with Miami's housing costs, with mid-career bankers earning $150,000 finding that purchasing desirable properties in Coral Gables or Fort Lauderdale's beachside requires $700,000 to $1.2 million, creating challenges despite solid incomes.

International trade through PortMiami (America's leading cruise port and major cargo facility) and Port Everglades (nation's third-busiest container port) creates logistics, customs brokerage, freight forwarding, and trade-related employment. Port operations employ thousands in positions paying $45,000 to $95,000 depending on specialization. The ports' Caribbean and Latin American trade focus distinguishes them from other major U.S. ports, creating specialized expertise in regional trade patterns. However, these middle-class port workers face severe housing affordability challenges, with longshoremen earning $75,000 finding homeownership increasingly out of reach as prices appreciated beyond wage growth.

The tourism economy employs massive workforces across hotels, restaurants, attractions, cruise operations, and service industries serving 23 million annual visitors to Miami-Dade and millions more to Broward and Palm Beach Counties. South Beach hotels, Brickell high-rises, Fort Lauderdale beachfront resorts, and properties throughout the region employ workers earning $28,000 to $55,000 in housekeeping, front desk, restaurant service, and various hospitality positions. These service workers—the people who make South Florida's tourism economy function—face complete pricing out from homeownership, with the combination of low wages and extreme housing costs forcing hour-plus commutes from far western suburbs or relegating workers to permanent rental status often in overcrowded conditions.

Healthcare employment through multiple major systems including Jackson Health System (Miami-Dade's public hospital system), Baptist Health South Florida, Cleveland Clinic Florida, Memorial Healthcare System, Broward Health, and numerous other providers employs tens of thousands of nurses, physicians, medical technicians, and administrators. Nurses earn $68,000 to $98,000, solid salaries that would support comfortable homeownership in most Florida metros but prove inadequate in Miami-Fort Lauderdale where homes in reasonable suburban locations start at $450,000 requiring monthly payments exceeding $3,500 including insurance. Physicians earn $190,000 to $450,000 depending on specialty, finding that even high incomes strain to afford premium locations where single-family homes run $850,000 to $1.5 million-plus. Healthcare workers increasingly face impossible choices: accept hour-plus commutes from affordable distant suburbs, spend unsustainable percentages of income on housing in desirable locations, or leave South Florida entirely for markets where healthcare salaries align better with housing costs.

The technology sector has emerged over the past decade as South Florida pursues "Silicon Beach" aspirations. Venture capital funding has increased, startups have launched, established tech companies including Microsoft, Google, and others have expanded Miami operations, and the city has attracted technology workers and entrepreneurs from expensive coastal markets. However, the scale remains far below Austin's massive tech concentration or Research Triangle's decades of development. Software engineers, IT professionals, and tech workers earn $85,000 to $180,000, finding Miami's costs have eliminated any affordability advantage—a senior engineer earning $140,000 discovers that purchasing a home in a desirable Fort Lauderdale suburb requires $700,000 to $900,000, not materially different from expensive tech hubs the sector supposedly escaped.

The real estate, development, and construction industries themselves represent massive employment given South Florida's constant building activity. Real estate agents, developers, property managers, title companies, mortgage brokers, and construction workers create an ecosystem where hundreds of thousands work in housing-related industries, with income ranging from $35,000 for construction laborers to $150,000-plus for successful agents and developers. The irony is palpable: many workers building luxury condos and single-family homes cannot afford to purchase the properties they construct.

The tax structure delivers Florida's zero state income tax, creating savings of $5,000 to $15,000 annually for households earning $100,000 to $220,000—substantial amounts that attracted waves of New York, California, and international relocators. However, property taxes around 1.0% to 1.2% of assessed value and catastrophic insurance costs exceeding $8,000 to $18,000 annually for property coverage plus another $3,000 to $8,000 for flood insurance largely offset the tax advantage, meaning total housing costs frequently exceed what high-tax states would charge despite Florida's reputation.

The cost of living has reached crisis levels. Quality new construction in desirable Fort Lauderdale suburbs including Weston, Parkland, Coral Springs, and Plantation now ranges $550,000 to $850,000—prices that would purchase luxury homes in Dallas or excellent properties in Tampa. Miami-Dade suburbs including Kendall, Pinecrest, and Coral Gables run $480,000 to $1.2 million depending on location. Anything approaching beaches commands extreme premiums—Fort Lauderdale beachside starts at $800,000 for modest condos and exceeds $1.5 million for single-family homes, while Miami Beach runs $900,000 to $3 million-plus. The appreciation has been explosive and sustained—many submarkets appreciated 55% to 75% from 2020 to 2024, far exceeding income growth and creating the affordability crisis that defines modern South Florida. A household earning Miami's median income of $59,000 cannot afford a median-priced home at $580,000—the math simply doesn't work without substantial down payments from family wealth, dual six-figure incomes, or other advantages that the majority of workers don't possess.

The climate delivers year-round warmth and beach access attracting millions, though summer heat and humidity create oppressive conditions. Temperatures remain above 65 degrees most winter days, with true cold extremely rare. Summer heat and humidity from May through October create heat index values regularly exceeding 105 degrees when humidity combines with temperatures in the upper 80s to low 90s. Sea breezes provide some relief in coastal areas. Afternoon thunderstorms develop almost daily during summer. Annual precipitation averages 60+ inches. Hurricane season from June through November creates extreme risk that has materialized repeatedly—Hurricane Andrew's 1992 direct hit devastated South Dade, Hurricane Wilma's 2005 impacts, Hurricane Irma's 2017 catastrophic damage, and numerous near-misses demonstrate that South Florida faces the nation's highest hurricane risk. The combination of hurricane exposure, sea level rise concerns, and climate change create genuine long-term risks that affect insurance availability, property values, and the very viability of coastal development. However, for those who can afford the costs and risks, year-round warmth, beach lifestyle, international character, and cultural diversity create an environment that attracts people willing to pay extreme premiums for access.

Understanding Miami-Fort Lauderdale by buyer profile, submarket, and extreme stratification

The market's size, international character, and economic stratification create buyer profiles spanning ultra-wealthy international investors to struggling service workers, across multiple distinct submarkets with dramatically different characters and price points.

For International Buyers and Latin American Families: Venezuelan, Colombian, Argentine, Brazilian, and other Latin American buyers represent unique demand unconnected to local employment or financing. Wealthy families purchase properties from $800,000 condos to $3 million-plus single-family homes, often paying cash without mortgages, creating demand that local workers cannot compete against. They concentrate in Brickell (Miami's financial district with luxury high-rises), Coral Gables (established wealth, tree-lined streets, top schools), Aventura (luxury condos and shopping), Sunny Isles Beach (condo towers nicknamed "Little Moscow" for Russian buyer concentration alongside Latin Americans), Fort Lauderdale Intracoastal communities, and other premium areas. These buyers view Miami real estate as capital preservation rather than primary residences, often maintaining properties used several months annually while residing primarily in home countries. Some purchase multiple properties as investments. The cash transactions, lack of financing constraints, and willingness to pay premiums for safe-haven assets drive prices beyond what local incomes justify. Real estate agents specializing in international clients report transactions where buyers purchasing $2 million properties never see them in person, conducting entire purchase processes through representatives. This creates a parallel market operating by different rules than traditional U.S. housing markets, where employment, income multiples, and mortgage qualification don't constrain prices. However, the international buyer presence has declined somewhat from 2015-2019 peaks as some source countries' economic situations evolved and as increased scrutiny of money laundering and beneficial ownership reporting requirements affected certain transaction types.

For Finance and Banking Professionals: The international banking sector employs wealth managers, private bankers, investment advisors, and financial professionals earning $100,000 to $300,000-plus serving Latin American and international clients. These high earners struggle with Miami's costs despite solid incomes. A wealth manager earning $160,000 discovers that purchasing a home in Coral Gables, Pinecrest, or Fort Lauderdale's Rio Vista requires $850,000 to $1.3 million, creating challenges despite six-figure income. Dual-income households where both spouses work financial services creating combined incomes of $250,000 to $400,000 can access premium properties from $900,000 to $1.5 million, though even these households face sticker shock at insurance costs that can exceed $15,000 annually when property and flood coverage combine. Financial professionals prioritize locations offering reasonable commutes to Brickell and downtown Miami offices or Fort Lauderdale financial district, communities with top-rated schools for families with children (Miami-Dade's school system is challenging but specific schools and charter schools provide quality options), and neighborhoods with other professionals in cities where wealth concentration creates visible inequality. New construction serves this market from $600,000 in outer suburbs to $1.2 million-plus in premium locations, though supply remains limited as builders focus on ultra-luxury segments where international buyers provide demand regardless of local incomes.

For Technology Workers and "Silicon Beach" Professionals: The emerging tech sector employs software engineers, data scientists, product managers, and tech professionals earning $95,000 to $200,000, discovering Miami's costs approach or exceed the expensive tech hubs they supposedly escaped. A senior engineer earning $145,000 finds that Fort Lauderdale suburbs where tech workers concentrate—Plantation, Weston, Coral Springs—require $650,000 to $850,000 for quality homes, not dramatically different from Austin prices and approaching Bay Area suburb levels despite Miami's tech sector remaining far smaller than actual technology hubs. Tech workers brought high salary expectations and willingness to pay substantial prices, contributing to appreciation that made Miami less affordable for everyone. They prioritize locations offering fiber internet infrastructure, proximity to coworking spaces and tech company offices concentrated in Wynwood, Brickell, and Fort Lauderdale, and communities with other educated professionals. Many tech workers are remote employees maintaining Bay Area or New York salaries, making $700,000 homes feel accessible despite representing upper-tier Miami pricing, though even they face sticker shock at insurance costs approaching $12,000 to $18,000 annually for properties approaching beaches or in flood zones.

For Healthcare Professionals Facing Affordability Challenges: Major hospital systems employ nurses earning $68,000 to $98,000, medical technicians earning $52,000 to $78,000, and physicians earning $190,000 to $450,000, creating income spectrum where even physicians struggle with premium location costs. Nurses find homeownership increasingly impossible, with single-income nurse households earning $75,000 unable to qualify for homes starting at $450,000 in distant western suburbs of both counties. Dual-nurse households earning $150,000 to $190,000 combined can purchase homes from $500,000 to $680,000 in locations including western Broward suburbs (Sunrise, Plantation, Coral Springs), western Miami-Dade (Kendall, Cutler Bay, West Kendall), or Palm Beach County's southern suburbs (Boynton Beach, Delray Beach), though commutes to hospital campuses can exceed 45 to 75 minutes through brutal I-95 and Florida Turnpike traffic. Physicians earning $250,000 to $450,000 purchase homes from $700,000 to $1.4 million-plus in premium locations including Coral Gables, Pinecrest, Fort Lauderdale beachside communities, and Boca Raton, finding that even high medical incomes create challenges when insurance costs exceed $14,000 annually and property taxes approach $10,000 annually on million-dollar properties. Healthcare professionals often express frustration that major medical markets like Dallas, Houston, or San Antonio offer similar career opportunities with housing costs 40% to 60% lower, creating retention challenges as experienced nurses and physicians consider relocating to markets where healthcare salaries align better with housing costs.

For Tourism and Service Industry Workers Facing Complete Pricing Out: The tens of thousands of hotel workers, restaurant servers, retail employees, and service industry workers earning $30,000 to $52,000 annually—the people who make South Florida's tourism economy function—face total exclusion from homeownership. Even dual-income service worker households earning combined $65,000 to $95,000 cannot qualify for homes starting at $420,000 in the most affordable distant suburbs. These workers increasingly commute from far western suburbs—Homestead, Florida City, West Palm Beach, and even beyond metro boundaries—spending 90 to 120 minutes each direction in traffic, spending $300 to $450 monthly on fuel, and sacrificing enormous portions of their lives to commuting because living closer to employment remains financially impossible. Many service workers double-up in apartments or rent rooms in houses, creating overcrowded conditions that allow survival but prevent wealth building through homeownership. This represents South Florida's central housing crisis and long-term sustainability question: if the workers who clean hotels, serve restaurants, and staff retail cannot afford to live in the region, what happens to service quality, workforce availability, and basic economic function? Some employers have increased wages to $18 to $22 hourly trying to attract workers, but even these increases pale against housing appreciation that added $200,000 to $350,000 to home prices in five years.

For Retirees with Substantial Assets and Fixed Incomes: South Florida attracts substantial affluent retiree settlement from Northeast and Midwest states, seeking year-round warmth, beach access, and zero income tax on retirement income. However, Miami-Fort Lauderdale's extreme costs mean retirees need substantial assets—typically $500,000 to $1 million-plus in retirement savings plus Social Security and pensions totaling $70,000 to $150,000 annually. They purchase homes from $480,000 for modest communities in western suburbs to $850,000-plus for properties near beaches or in 55-plus communities with extensive amenities. Single-story layouts accommodate aging, master-on-main configurations provide flexibility, and proximity to major healthcare systems matters increasingly with age. The zero income tax benefits retirees substantially—someone with $120,000 retirement income saves $7,000 to $12,000 annually versus states taxing retirement income. However, insurance costs of $10,000 to $16,000 annually (property plus flood) consume substantial portions of fixed retirement incomes, creating situations where retirees paid substantial sums for homes but struggle with ongoing carrying costs that escalate annually as insurance premiums increase 20% to 40% following major storm years. Some retirees who purchased 10 to 15 years ago at prices of $280,000 to $420,000 now own homes worth $580,000 to $850,000, creating wealth on paper while facing insurance and tax increases that strain fixed incomes. The large retiree population creates communities and services catering to older adults, though Miami-Fort Lauderdale maintains younger demographics than Southwest Florida or retirement-focused areas given the international character and employment diversity.

For Condo Buyers Facing Special Assessment Risks: South Florida's massive condo inventory—particularly older buildings along coastlines—creates unique considerations following the Surfside tragedy. The June 2021 Champlain Towers South collapse killing 98 people revealed systemic maintenance failures, insufficient reserve funding, and the challenges of managing aging coastal buildings facing saltwater corrosion, concrete spalling, and structural deterioration. Florida's subsequent legislative response requiring 40-year structural inspections, milestone inspections, and fully funded reserves has created crisis conditions in older condos where special assessments of $50,000 to $200,000-plus per unit become necessary to fund repairs and meet reserve requirements. Some older condos have become essentially unsaleable as lenders refuse financing without structural reports and reserve funding that buildings cannot provide. Buyers considering condos face enormous complexity: newer buildings (under 10 years) generally avoid near-term assessment risks though still face Florida's insurance crisis affecting master policies. Buildings aged 30 to 50 years face highest risks, requiring extreme scrutiny of inspection reports, reserve studies, meeting minutes discussing deferred maintenance, and financial health before purchase. Waterfront condos face particular challenges given saltwater exposure accelerating corrosion. The condo market bifurcation has created opportunities for cash buyers willing to accept risks purchasing distressed units at discounts, while financing buyers focus on newer construction or buildings with documented structural health and adequate reserves.

For First-Time Buyers Facing Near-Impossible Barriers: Miami-Fort Lauderdale's appreciation has eliminated first-time buyer access for the overwhelming majority of local workers. Townhomes in distant western suburbs start around $340,000, requiring $11,900 down with FHA loans. Starter single-family homes begin at $420,000 in far western Broward or southern Palm Beach County suburbs, requiring $14,700 down. Young professionals, healthcare workers, teachers, and service industry workers earning $65,000 to $105,000 combined income struggle to qualify for homes that appreciated 60% to 70% over four years while incomes rose only 15% to 20%. The combination of elevated prices, insurance costs approaching $600 to $800 monthly, property taxes, and HOA fees means first-time buyers face monthly housing costs of $3,400 to $4,200 for modest properties, requiring household incomes exceeding $120,000 to qualify comfortably—levels that exclude the vast majority of Miami-Fort Lauderdale's workforce. Many young professionals have abandoned homeownership hopes entirely, planning to rent indefinitely or relocate to affordable markets. Those who do purchase typically benefit from family down payment assistance, dual six-figure professional incomes, or accepting far-flung locations in Homestead, western Palm Beach County, or beyond metro boundaries requiring commutes exceeding 90 minutes.

For Investors Facing Regulation and Market Changes: Miami-Fort Lauderdale's tourism economy and international buyer presence created substantial investment demand for short-term rentals and long-term investment properties. However, the market has changed substantially. Short-term rental regulations have tightened dramatically, with Miami Beach and other municipalities restricting or banning short-term rentals in residential areas following complaints about party houses and neighborhood disruption. Many condos prohibit rentals under 6 or 12 months. The Surfside collapse and subsequent regulatory changes affect investor calculations. Insurance costs approaching $12,000 to $18,000 annually for investment properties plus property taxes and management fees consume substantial portions of rental income. Many investors who purchased 2020-2022 at peak prices face negative cash flow when rental income fails to cover costs. Some international investors who purchased cash maintain properties regardless of rental income, viewing real estate as capital preservation, but domestic investors relying on rental income face challenges. The long-term rental market remains strong given the affordability crisis creating permanent renter classes, with single-family homes renting for $3,200 to $5,500 monthly in suburban locations, though landlords face insurance and tax increases that force rent increases affecting affordability crisis.

The catastrophic costs beyond mortgage payments

Your actual monthly housing expense in Miami-Fort Lauderdale extends beyond principal and interest, with Florida's insurance crisis reaching its absolute worst in South Florida's high-risk coastal environment, creating costs that shock even wealthy relocators.

- Property taxes in South Florida run approximately 1.00% to 1.20% of assessed value when combining city, county, school district, and various entities. Miami-Dade County runs about 1.05% to 1.20%. Broward County sits around 1.00% to 1.15%. Palm Beach County carries approximately 0.95% to 1.10%. On a $650,000 home, annual property tax bills range from roughly $6,500 to $7,800. Florida's Save Our Homes caps assessment increases at 3% annually for homesteaded properties, protecting long-term owners but creating enormous disparity where recent buyers pay double or triple the taxes of neighbors in identical homes purchased years earlier. A home purchased in 2015 for $380,000 now worth $750,000 might carry $4,500 annual taxes due to Save Our Homes protection, while an identical home purchased in 2023 for $750,000 pays $8,250 annually—creating inequity that forces recent buyers to subsidize longtime residents. The homestead exemption reduces assessed value by $50,000 for primary residences.

- Sales tax ranges from 6.5% to 7.0% across the counties, with Florida collecting 6% and counties adding 0.5% to 1.0%. This affects major purchases.

- Homeowner's insurance represents South Florida's most catastrophic housing cost, with Florida's insurance crisis reaching absolute worst-case conditions in the hurricane-exposed coastal environment. Annual premiums typically range from $8,000 to $18,000 for standard single-family homes depending on coverage levels, home value, construction type, roof age, proximity to coast, and elevation. Properties near beaches or waterfront face premiums at the upper end or beyond, sometimes reaching $22,000 to $35,000 annually for homes valued $900,000 to $1.5 million in coastal locations. Hurricane deductibles typically apply as 2% to 5% of dwelling value, meaning a $700,000 home carries $14,000 to $35,000 hurricane deductible applying when named storms strike. Every major national carrier has either exited Florida entirely or drastically reduced exposure—State Farm, Allstate, Farmers, Liberty Mutual, and others no longer write new Florida homeowner policies. This forces buyers toward Citizens Property Insurance (Florida's insurer of last resort now covering over 1 million policies and facing potential insolvency if major hurricane creates catastrophic losses) or surplus lines carriers charging 80% to 150% higher premiums than standard market previously charged. Roof age drives availability absolutely—insurers refuse coverage entirely for roofs over 10 years old, forcing buyers to replace $35,000 to $55,000 roofs to obtain any insurance regardless of actual condition. New construction with impact-resistant windows, reinforced roof systems, concrete construction, and current code compliance earns better rates, though "better" still means $9,000 to $14,000 annually in most cases. The insurance market deteriorates continuously, with premiums increasing 25% to 45% annually following major storm years, creating situations where homeowners face insurance costs that double or triple within five years, making properties unaffordable even for owners who purchased years ago at moderate prices.

- Flood insurance affects massive percentages of Miami-Dade, Broward, and Palm Beach properties given low-lying coastal geography, sea level rise concerns, and extreme rainfall during hurricanes. Properties in FEMA Special Flood Hazard Areas require flood insurance when using mortgages, with costs ranging from $2,800 to $8,500 annually depending on elevation relative to base flood elevation, coverage limits, and specific zone designation. However, Hurricane Irma and other events demonstrated that catastrophic flooding extends far beyond mapped zones when storm surge and extreme rainfall combine, leading prudent buyers to purchase flood coverage even outside designated zones, adding $1,800 to $4,500 annually. The National Flood Insurance Program caps structure coverage at $250,000, forcing buyers of properties valued $500,000-plus into private flood market at extreme premium costs. Some coastal properties face combined wind and flood insurance approaching $18,000 to $28,000 annually—costs that make homeownership economically questionable even for high earners. The flood insurance situation worsens as FEMA updates flood maps reflecting sea level rise and improved risk modeling, moving previously "safe" properties into flood zones requiring coverage.

- Condo association fees for buildings with amenities, waterfront locations, or extensive common areas can reach $800 to $2,500 monthly, representing substantial ongoing costs beyond what single-family homes face. Following Surfside, reserve requirements have created special assessments in older buildings ranging from $30,000 to $180,000-plus per unit, devastating fixed-income retirees and creating situations where unit values collapse as assessments become public.

- Utility costs favor new construction given South Florida's year-round cooling requirements. Florida Power & Light (FPL) serves most of the region. Air conditioning runs continuously year-round, though most intensely May through October. Older homes see bills exceeding $320 monthly for 2,500 square foot homes during peak summer. New construction with modern insulation, efficient HVAC systems, and hurricane-rated windows runs 30% to 35% lower, though bills still reach $210 to $280 during peak months.

- HOA fees vary dramatically. Standard single-family communities charge $100 to $300 monthly. Master-planned communities can reach $350 to $650 monthly funding extensive amenities. Waterfront communities carry higher fees maintaining docks and seawalls. Gated communities with security add costs.

- Traffic and commute costs create enormous time and financial burdens. I-95 through Miami-Fort Lauderdale ranks among America's most congested highways, with rush hours extending from 6 AM to 11 AM and 3 PM to 8 PM on weekdays. The Florida Turnpike, Palmetto Expressway, and other major routes function as parking lots during commute times. Workers commuting from affordable distant suburbs to employment centers regularly spend 90 to 120 minutes each direction, burning $350 to $500 monthly in fuel plus vehicle wear and tolls on multiple toll roads. Some workers spend 3 to 4 hours daily commuting, sacrificing enormous portions of their lives because living closer to employment remains financially impossible. The combined cost structure—property taxes around $600 monthly, insurance $750 to $1,500 monthly, flood insurance $250 to $600 monthly, HOA fees $150 to $400 monthly—creates $1,750 to $3,500 monthly in expenses beyond principal and interest, meaning total monthly housing costs on a $650,000 home can reach $5,500 to $6,800 including mortgage, completely excluding the working-class and middle-class buyers while straining even high-earning professionals.

What new construction delivers in America's highest-risk market

Choosing new construction in Miami-Fort Lauderdale provides advantages addressing hurricane risk, flood exposure, insurance cost management, and the requirements of international buyers and wealthy professionals who can afford current pricing.

- Maximum Hurricane and Flood Protection: Post-Andrew Florida building codes require extreme hurricane protection, with South Florida facing the strictest requirements. New construction includes hurricane straps, reinforced concrete construction (concrete block or poured concrete superior to wood-frame), impact-resistant windows and doors eliminating shutter requirements, reinforced roof systems with enhanced attachment exceeding minimum code, and elevation addressing flood risk. These features earn insurance discounts that can reduce premiums 30% to 50% compared to older homes—though applying discounts to baseline premiums of $12,000 still results in $7,000 to $9,000 annually, the savings compound substantially. New construction significantly outperforms older homes during hurricanes, with post-Andrew code homes showing dramatically less damage during major storms.

- Flood Elevation and Advanced Engineering: New construction in flood zones or near water must elevate substantially above base flood elevation, with many builders going 2 to 4 feet above minimum requirements. This dramatically reduces flood insurance costs while providing genuine protection during storm surge events. Modern drainage systems, engineered stormwater management, and proper grading all address South Florida's low-lying topography.

- Modern Systems and Technology: New construction includes smart home systems, advanced HVAC with superior dehumidification (critical in South Florida's humidity), backup generator pre-wiring or installation (essential given power outages during hurricanes), and electrical systems accommodating modern demands including electric vehicle charging.

- Warranty Protection in Extreme Environment: Builder warranties covering structural issues for 10 years, major systems for 2 to 5 years, and workmanship for the first year provide protection in an environment where hurricane damage, saltwater corrosion, and extreme weather create ongoing maintenance demands.

Understanding construction timelines with maximum disruption risk

- For inventory homes, closings typically happen within 50 to 100 days. Permitting across Miami-Dade, Broward, and Palm Beach Counties maintains varying efficiency, with some municipalities moving faster than others.

- For to-be-built homes, realistic expectations run 10 to 16 months given regulatory requirements, hurricane season disruptions, and supply constraints. Hurricane season creates extreme uncertainty—when major storms strike or threaten, construction halts entirely for days or weeks, with recovery taking months as contractors prioritize repairs over new construction. Contracts must address hurricane delays extensively, potentially allowing 60 to 90-day extensions for major storms while capping total delays at 120 to 150 days.

Financing in extreme-cost, high-risk market

Most builders maintain preferred lender relationships offering incentives from $8,000 to $20,000 in closing cost credits given the price points.

Florida's zero income tax benefits all buyers. However, insurance costs devastate qualification calculations. On a $650,000 home with approximately $600 monthly property tax, $950 monthly property insurance, and $400 monthly flood insurance, total housing payment reaches approximately $5,500 monthly. This requires household income exceeding $190,000 to qualify comfortably—explaining why Miami-Fort Lauderdale excludes the majority of workers.

International buyers often pay cash, avoiding financing entirely. Domestic buyers face conventional lending with substantial down payments standard given price points.

Why market-expertise representation matters critically

The market's complexity, international character, insurance crisis, condo risks, and multiple submarkets make specialized representation essential.

Independent buyer's agents help navigate which submarkets offer best value, evaluate true insurance costs before purchase, assess flood zone implications, understand condo association health and assessment risks, identify builder reputations, and ensure contracts protect buyers in the nation's highest-risk housing market where hurricane damage, insurance availability, sea level rise, and market volatility create risks that no other major metro combines at South Florida's extreme levels, where wealth-building opportunities from appreciation come paired inseparably with catastrophic cost increases, climate risks, and the reality that Miami-Fort Lauderdale has become America's least affordable major metro relative to local wages, creating a market that functions increasingly as a playground for international capital and wealthy professionals while pricing out the working-class and middle-class families who once made Florida homeownership accessible, leaving them permanently renting or commuting hours from distant affordable suburbs in a region where the American Dream of homeownership has become, for most local workers, an impossible aspiration in America's most expensive and highest-risk housing market.

Where can I find new homes?

Browse currently available new construction homes, communities, and floor plans across the Miami Metropolitan Area. All listings are updated daily with the latest inventory from builders. Browse all communities & new homes in Miami Metropolitan Area

Top-rated new construction communities in Miami Metropolitan Area

Master planned communities in Miami Metropolitan Area

Browse communities & homes in Miami Metropolitan Area cities

Real estate in Miami Metropolitan Area

Miami's real estate market has long been a hotbed of activity, with buyers and sellers worldwide flocking to the city searching for their dream homes. According to the Miami Association of Realtors, the median sales price for single-family homes in Miami-Dade County in January 2022 was $520,000, up 18.2% from the previous year. The market has experienced significant growth in recent years, driven by population growth, job opportunities, and a favorable tax environment. The Miami real estate market is known for being dynamic and diverse, with a range of housing options available to suit different lifestyles and budgets. From luxurious waterfront homes and high-rise condos to family-friendly suburbs and up-and-coming neighborhoods, there is something for everyone in Miami. Buyers are willing to pay a premium for properties with desirable features like outdoor space, water views, and modern finishes.

Newly released communities

Recently listed homes

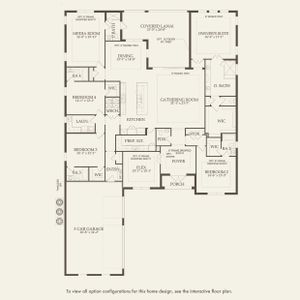

Recently published floor plans

The most popular new construction builders in Miami Metropolitan Area

How does Miami - Ft. Lauderdale, FL compare to other real estate markets in Florida?

Jacksonville Metropolitan Area3,923 homes3% less homes than in Miami - Ft. Lauderdale, FL79% lower median price

Jacksonville Metropolitan Area3,923 homes3% less homes than in Miami - Ft. Lauderdale, FL79% lower median price Greater Orlando Area7,659 homes89% more homes than in Miami - Ft. Lauderdale, FL78% lower median price

Greater Orlando Area7,659 homes89% more homes than in Miami - Ft. Lauderdale, FL78% lower median price Tampa Bay Area6,645 homes64% more homes than in Miami - Ft. Lauderdale, FL75% lower median price

Tampa Bay Area6,645 homes64% more homes than in Miami - Ft. Lauderdale, FL75% lower median price Gainesville–Ocala Area3,464 homes14% less homes than in Miami - Ft. Lauderdale, FL84% lower median price

Gainesville–Ocala Area3,464 homes14% less homes than in Miami - Ft. Lauderdale, FL84% lower median price Space Coast842 homes79% less homes than in Miami - Ft. Lauderdale, FL80% lower median price

Space Coast842 homes79% less homes than in Miami - Ft. Lauderdale, FL80% lower median price Treasure Coast1,768 homes56% less homes than in Miami - Ft. Lauderdale, FL75% lower median price

Treasure Coast1,768 homes56% less homes than in Miami - Ft. Lauderdale, FL75% lower median price

Read about new construction on Jome blog

Frequently asked questions

What is the current median sale price for a property in Miami Metropolitan Area?

December 2025 data indicates that the median sale price of properties in Miami Metropolitan Area, is $1,895,000. Buyers have a wide choice among 4005 new construction homes from 131 builders, each offering distinct features and designs.

Who are the major developers of new construction homes in Miami Metropolitan Area?

The landscape of new homes in Miami Metropolitan Area is shaped by the work of Lennar, D.R. Horton, Related Group, GL Homes and DiVosta. These developers offer a range of new construction options across the area.